Tag Archives: California Department of Insurance

Consumer groups ask CA governor to halt insurance industry discussions, say they’ve been left out

CFC in the News || By Michael Finney || ABC 7 SACRAMENTO, Calif. (KGO) — Information floating around Sacramento points to an industry push for a major change in California’s insurance regulations. “Rumors are abundant, but the thread through all of this is the consumer groups — we … Read More ›

National General Insurance/Wells Fargo: California Consumer Group Files Petition to Reject Auto Insurance Rate, Investigate Fraud and Collusion

The Consumer Federation of California (CFC) filed a petition today with the California Department of Insurance (CDI) opposing an application by National General Insurance for a 6.9% increase in premiums for certain vehicle policies. Acting under Proposition 103, the CFC asked CDI to investigate National General’s automobile … Read More ›

California Insurance Commissioner Expresses Skepticism Over Anthem-Cigna Merger

by Ana B. Ibarra, KQED

“We are not aware of any peer-reviewed studies that have found that higher insurer market concentration has led to lower health insurance premiums,” [one expert] said. … Consumer advocates said the acquisition would make existing problems with health insurance worse. Anthem, they claimed, has already struggled with inaccuracies in provider directories, low quality ratings and poor management of grievances. Read More ›

California’s Four Largest Health Plans Could Owe State $10 Billion In Back Taxes

by Tracy Seipel, San Jose Mercury News

Blue Shield and Blue Cross already lost a key round in a state appellate court. The case against Kaiser and Health Net heads to a Los Angeles court Friday. At the heart of the debate is a century-old section in the state constitution that requires almost all insurers to pay a 2.35 percent tax on the premiums they collect each year. The tax is paid in lieu of almost all other state taxes. Yet for decades, industry critics say, Kaiser, Blue Cross, Blue Shield and Health Net have managed to avoid paying the premium tax on the majority of their business. Read More ›

California Regulators Are Urged To Scrutinize Health Insurance Mega-Mergers

by Chad Terhune, Los Angeles Times

There’s a lot at stake for families and employers if the deals go through and leave three health insurers in control of nearly half of the U.S. commercial insurance market. … Much of the debate centers on whether insurers should be required to limit rate increases for a time, expand their provider networks and make other pledges to improve patient care in order to win regulatory approval at the state level. … Consumer advocates say they fear that existing problems over affordability and access to care will get worse as insurers consolidate market power. Read More ›

Nonprofit Blue Shield Accused Of Backing Out Of $140-Million Charity Pledge

by Chad Terhune, Los Angeles Times

Blue Shield’s corporate conduct has come under intense scrutiny for the past year after officials revoked its longtime state tax exemption. Auditors at the California Franchise Tax Board criticized the insurer for stockpiling “extraordinarily high surpluses” of $4 billion and for failing to offer more affordable coverage as a nonprofit. California Insurance Commissioner Dave Jones is also investigating Blue Shield’s disclosures on executive compensation. Read More ›

CFC Saved Drivers Over $15 Million On Insurance In 2015

Hartford and Safeco had both sought to boost auto insurance rates by almost 7%, but CFC challenged the rate hike proposals. The result: $5 million in auto policy savings for Hartford customers and $10 million for Safeco customers. In August, GEICO agreed to pay $6 million to settle CFC’s complaint alleging the insurance giant violated civil rights and insurance law by targeting women and unmarried, lower-income motorists with deceptive and inflated automobile insurance rate quotes. It is difficult to calculate motorists’ potential savings resulting from the settlement, but CFC estimates it may reach several million dollars annually. Read More ›

Auto Insurance Company GEICO Pays Out Multi-Million Dollar Settlement

by Tom Vacar, Fox 2 (KTVU Oakland)

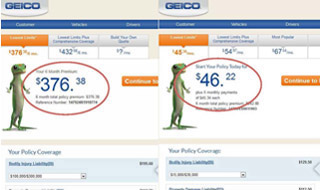

The Consumer Federation of California charges that GEICO tried to discourage less preferable customers. Those include those not college-educated, not professional, not executive, a woman, an unmarried person, or those not currently insured. They would not be offered those lowest legal minimum [rates]. Read More ›

Geico Pays $6M To Settle Insurance Discrimination Claim

by Kathleen Pender, San Francisco Chronicle

Geico will pay $6 million to settle a complaint alleging it illegally discriminated against women, unmarried people, blue-collar workers and those without four-year college degrees by showing them costlier auto insurance policies on its Web site than it showed other potential customers. “We believe the primary intent was to drive these folks away from Geico to someone else’s Web site or at least make sure they were paying a lot more money if they didn’t drive them away,” said Richard Holober, executive director of the Consumer Federation of America, the nonprofit advocacy group that filed the complaint. Read More ›

GEICO Pays $6 Million To Settle CFC Civil Rights, Deceptive Rate Quote Complaints

GEICO agreed to pay $6 million to settle a Consumer Federation of California complaint alleging the insurance giant violated civil rights and insurance laws by targeting low- and moderate-income women and unmarried motorists with deceptive and inflated automobile insurance rate quotes. “This is an important win for all California motorists,” said CFC Executive Director Richard Holober. “GEICO is paying a price for its unfair practices, and the settlement assures that all good drivers are treated equally, whether rich, poor, or in between. It sets a new industry standard for rate quotes that are accurate and transparent.” Read More ›

California Tax Officials Blast Blue Shield In Audit

by Chad Terhune, Los Angeles Times

Blue Shield’s operations are indistinguishable from those of its for-profit healthcare competitors, the auditors found, and it should be stripped of the tax break it has enjoyed since its founding in 1939. The insurance giant does not advance social welfare, the key test for preserving its tax exemption, according to the records. … Since the revocation became public, Blue Shield has come under increasing scrutiny from regulators, lawmakers and consumer groups over its massive financial reserves and its proposed purchase of a Medicaid insurer for $1.2 billion. Read More ›

California Consumer Group Seeks Enforcement Action Against Geico

by Staff, The Insurance Journal

“Our extensive analysis of Geico’s online rate quote system found that it is programmed to target unmarried low or moderate-income drivers for inflated rates,” Richard Holober, executive director of the group stated. “Targeted motorists either pay for excessive coverages they are falsely told are the lowest available, or Geico drives them away with these costly quotes. Either way, Geico is breaking California’s insurance regulations and civil rights law.” Read More ›

ConsumerWatch: Geico Accused Of Discriminatory Insurance Quotes

When was the last time your car insurance company asked about your job or if you had a college degree? On the Consumer Watch, Julie Watts says some are questioning the legality of Geico’s practices.