Tag Archives: Insurance

WHY IS THE INSURANCE COMMISSIONER COLLUDING WITH LIFE INSURERS TO UNDERMINE CONSUMERS AND THE BIDEN ADMINISTRATION?

The CA Dept. of Insurance is sponsoring a bill heavily influenced by life and annuity insurers that undermines what Biden’s Department of Labor has proposed to keep consumers away from unsuitable products Bill being rushed months before deadline harms consumers; no meaningful negotiations despite bill’s previously being … Read More ›

Consumer groups ask CA governor to halt insurance industry discussions, say they’ve been left out

CFC in the News || By Michael Finney || ABC 7 SACRAMENTO, Calif. (KGO) — Information floating around Sacramento points to an industry push for a major change in California’s insurance regulations. “Rumors are abundant, but the thread through all of this is the consumer groups — we … Read More ›

California Attorney General Joins Federal Suit To Block Anthem-Cigna Merger

by Lisa Aliferis, KQED

In California, Anthem Blue Cross is a huge player with about 20 percent of private insurance market. Cigna has a smaller presence here, but the two companies “compete head-to-head for customers, especially large employers,” the attorney general’s office said. Read More ›

California Insurance Commissioner Expresses Skepticism Over Anthem-Cigna Merger

by Ana B. Ibarra, KQED

“We are not aware of any peer-reviewed studies that have found that higher insurer market concentration has led to lower health insurance premiums,” [one expert] said. … Consumer advocates said the acquisition would make existing problems with health insurance worse. Anthem, they claimed, has already struggled with inaccuracies in provider directories, low quality ratings and poor management of grievances. Read More ›

Got A Health Care Grievance? There’s A Place To Complain

by Claudia Buck, Sacramento Bee

[MyPatientRights.org is] intended to provide an easy link to the state Department of Managed Health Care, which handles consumer complaints with the state’s 122 licensed health plans. … Last year, the help center received more than 102,000 requests for assistance. … Requests for help jumped by 60 percent compared with 2013, largely because of the implementation of the Affordable Care Act, according to the department. Read More ›

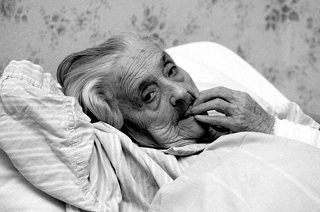

Abandoned Nursing Home Residents Live Months In Hospital, Waiting

by Anna Gorman, KQED

Nursing home residents are entitled to hearings under federal law to determine whether they should be readmitted after hospitalization. The state Department of Health Care Services holds the administrative hearings, but has said it is not responsible for enforcing the rulings. But the state Department of Public Health, which oversees nursing homes, neglects to enforce the rulings and sometimes disagrees with them, according to advocates and court documents. … And since many nursing home residents have publicly-funded insurance, it means taxpayers are on the hook for hospital stays long after the patients are ready for discharge. Read More ›

Taming Drug Prices By Pulling Back The Curtain Online

by Katie Thomas, New York Times

A few entrepreneurs say they are aiming to fundamentally change the way people buy drugs, bringing the industry into the digital age by disclosing the lowest prices for generic prescriptions to allow comparison-shopping. … Nearly 90 percent of the prescriptions dispensed in the United States are for generic drugs, according to IMS Health, a consulting firm. … The listed price for a 30-day supply of the generic version of Lipitor, for example, is $196 at Kmart, according to GoodRx, and $61 at Kroger. With a coupon obtained through GoodRx, the drug is about $12. Blink Health is offering Lipitor for $9.94. Read More ›

Hard Drives Holding Health Data Missing At Medical Insurer

by Chris Rauber, San Francisco Business Times

The latest in a series of huge data losses in the health care realm — health insurer Centene’s loss of six hard drives containing personal information on 950,000 enrollees — raises more questions about the security of health data that consumers entrust to insurance companies, hospital systems, Medicare, Medicaid and other big players. … Confidential health care data can sell in murky portions of the Internet for $10 to $50 per record — far more than the roughly $1 a simple credit-card number is worth. Medicare records are even more valuable, … and can sell for as much as $470 per record. Read More ›

California’s Four Largest Health Plans Could Owe State $10 Billion In Back Taxes

by Tracy Seipel, San Jose Mercury News

Blue Shield and Blue Cross already lost a key round in a state appellate court. The case against Kaiser and Health Net heads to a Los Angeles court Friday. At the heart of the debate is a century-old section in the state constitution that requires almost all insurers to pay a 2.35 percent tax on the premiums they collect each year. The tax is paid in lieu of almost all other state taxes. Yet for decades, industry critics say, Kaiser, Blue Cross, Blue Shield and Health Net have managed to avoid paying the premium tax on the majority of their business. Read More ›

California Regulators Are Urged To Scrutinize Health Insurance Mega-Mergers

by Chad Terhune, Los Angeles Times

There’s a lot at stake for families and employers if the deals go through and leave three health insurers in control of nearly half of the U.S. commercial insurance market. … Much of the debate centers on whether insurers should be required to limit rate increases for a time, expand their provider networks and make other pledges to improve patient care in order to win regulatory approval at the state level. … Consumer advocates say they fear that existing problems over affordability and access to care will get worse as insurers consolidate market power. Read More ›

Consumer Laws Taking Effect In 2016

The following consumer-related legislation was signed into law in 2015 and will take effect January 1, 2016, except as noted. Read More ›

DMV Issues Proposed Regulations For Self-Driving Vehicles

by Mark Glover, Sacramento Bee

“The liability issue is paramount,” [Consumers for Auto Reliability and Safety President Rosemary Shahan said.] “With this, what is the driver there for? So, you’re going to have less control and more liability. … Why would anyone lease a car like that?” … Addressing privacy and cybersecurity issues, the DMV said “manufacturers must disclose to the operator if information is collected, other than the information needed to safely operate the vehicle.” It said autonomous vehicles will be equipped with self-diagnostic capabilities that detect and respond to cyberattacks or “other unauthorized intrusions.” Read More ›

Supreme Court Rejects Class-Action Suit Against DirecTV

by Robert Barnes, Washington Post

“These decisions have predictably resulted in the deprivation of consumers’ rights to seek redress for losses, and turning the coin, they have insulated powerful economic interests from liability for violations of consumer protection laws,” wrote [dissenting Justice Ruth Bader] Ginsburg. … “It has become routine, in a large part due to this court’s decisions, for powerful economic enterprises to write into their form contracts with consumers and employees no class-action arbitration clauses … further degrading the rights of consumers and further insulating already powerful economic entities.” Read More ›