Smartphone theft a “national epidemic”?

by Editor, National Consumers League

According to the FCC, in San Francisco, about half of all robberies involved mobile phones and nationwide one in every three robberies involve a stolen cell phone. In total, 1.6 million Americans had a handheld device stolen last year. The San Francisco District Attorney has called smartphone theft “a national epidemic.” Read More ›

6 home appliances most likely to self-immolate

by Laura Northrup, Consumerist

Kitchen appliances make our lives more convenient and our meals more delicious, but they’re also dangerous. Ordinary appliances start tens of thousands of fires in United States homes every year. Here are the top six most common causes of kitchen appliance fires. Read More ›

Big California corporations parking $262 billion offshore

by Dan Walters, Sacramento Bee

A dozen of California’s largest corporations are holding nearly $262 billion in foreign earnings in offshore subsidiaries to shield the money from American taxation. California’s Apple was listed as having has the most offshore holdings of any American corporation at $82.66 billion. Read More ›

Manufacturers deceive consumers with “organic” product names

by Brit'ny Hawkins, Environmental Working Group

Manufacturers use the term “organic” in their product names to mislead consumers about the sources of the ingredients. The FDA does not define or regulate the term “organic” as it applies to cosmetics, body care or personal care products. Read More ›

Apple, Walmart, McDonald’s: Who’s the biggest wage stiffer?

by Paul Buchheit, Nation of Change

Apple, Walmart and McDonald’s are among the largest corporate employers and profit-makers in the U.S., with a total of 2.6 million employees worldwide and combined 2012 pre-tax profits of more than $88 billion. All three companies pay the majority of their employees low wages, poverty-level wages. Read More ›

Hounded by debt collectors? Knowing one’s rights key to dealing with collection agency tactics

by Associated Press, Washington Post

Debt collection can be an unpleasant business, but it’s a big one. The industry generates $12.2 billion in revenue for the roughly 4,500 firms chasing down borrowers who owe money on credit cards, auto loans and other accounts, according to figures from the Consumer Financial Protection Bureau. Read More ›

California officials call JPMorgan settlement ‘vindication’ for electricity charges

by Dale Kasler, Sacramento Bee

Calling it a “vindication for California ratepayers,” the managers of the state’s electricity grid today hailed a $410 million settlement between federal regulators and investment bank JPMorgan Chase & Co., and a return of $124 million in profits to California. Read More ›

How the post office sells your address update to anyone who pays (and the little-known loophole to opt out)

by Adam Tanner, Forbes

It’s all there in the fine print when you sign up for a change of address: “We do not disclose your personal information to anyone, except in accordance with the Privacy Act.” Then it lists a number of exceptions including “to mailers, if already in possession of your name and old mailing address, as an address correction service.” Read More ›

FDA’s proposed rules to improve safety of imported foods

by Chris Morran, The Consumerist

“We must work toward global solutions to food safety so that whether you serve your family food grown locally or imported you can be confident that it is safe,” said FDA Commissioner Margaret A. Hamburg, M.D. Read More ›

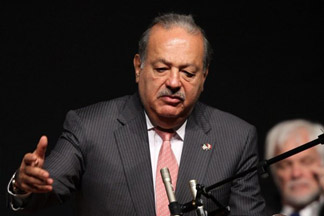

California political watchdog rebuffs request by Carlos Slim’s firm

by Marc Lifsher, Los Angeles Times

California’s political watchdog agency is not pursuing an enforcement action against an immigrants rights group that was requested by a company owned by Mexican billionaire Carlos Slim. Co-founder of the group said he was pleased that “the FPPC did not allow itself to be used by TracFone and Carlos Slim to do their dirty work.” Read More ›

Ballot measure filed to raise California’s medical damages cap

by Jeremy B. White, Sacramento Bee

A coalition has been lobbying this year to change a $250,000 cap on pain and suffering damages in medical malpractice lawsuits. They argue the current limit, put in place in 1975, is outdated and insufficient to cover the prolonged affects of doctor negligence or botched medical procedure. Read More ›

How to go completely invisible on Facebook

by Steven Tweedie, Business Insider

When you’re finished, no one but you will be able to see your Facebook activity, view your photos, or see where you’ve checked in. Your current friends will still be able to view your basic profile — there’s no way around this — but all your activity will be blank. Read More ›

Auditor gives high marks to PUC consumer support program disliked by utilities and corporations

by Ken Broder, AllGov.com

When consumers square off with big corporations and utilities before California’s Public Utilities Commission (PUC), it helps to have help. And they get some from the state, which funds the Intervenor Compensation Program to pay certain individuals and groups to participate in proceedings. Big corporations and utilities … Read More ›