Tag Archives: CFC

AB 925 Lets Debt Collectors, Subprime Lenders, Others Secretly Record Phone Calls

SACRAMENTO – A coalition of California consumer, privacy, senior, student, labor and immigrant advocates urge the defeat of Assembly Bill 925 (Evan Low, D-Campbell), which would eliminate a longstanding prohibition against secret recordings of consumer cell phone calls by subprime lenders, debt collectors, student loan companies, hotels, health care providers, retailers and other businesses. Key backers of AB 925 include AT&T, Verizon and high-tech corporate lobbyists. Read More ›

AB 925 Dies: Secret Recording Of Business-Customer Cell Phone Calls Remains A Crime

Democrats on the Assembly Committee on Public Safety approved AB 925 on a 5-2 party line vote after strenuous opposition from CFC and other consumer, privacy, senior, student, labor and immigrant advocacy groups weakened the bill. Amendments were not yet in print but reportedly would require notification to customers that a call may be recorded 20 seconds into a cell phone conversation, so it remains a bad bill. Read More ›

Privacy Getting Taken For A Ride

by Samantha Gallegos, Capitol Weekly

Sponsored by the Consumer Federation of California, a non-profit consumer-rights advocacy group, [Assembly Member Ed] Chau’s bill would set up privacy standards related to “personally identifiable data” that [Transportation Network Companies] — like Uber or Lyft — would be required to follow. Those standards don’t exist now, Chau said. “I guess you could say, well, protecting some personal data is better than protecting none,” said Richard Holober, executive director of the Consumer Federation. “Right now none is protected. And I don’t believe the flawed argument that Internet-based companies should have greater freedom than the other businesses who collect and share data.” Read More ›

AB 886 (Chau) Protects Uber Passenger Privacy

SACRAMENTO – Assembly Bill 886 (Chau, D-Monterey Park) will protect the sensitive personal information and credit card records of passengers using transportation network companies (TNCs) such as Uber. Read More ›

AB 886’s Privacy Protections For Uber Passengers Held Up

Update 6/1/2015: The deadline for bills to advance from committees to the Floor passed last week, forestalling any realistic chance of reviving AB 886 this session. The bill was defeated in the Assembly Utilities and Commerce Committee April 20. Committee Chair Anthony Rendon and Assembly Members Roger Hernandez, Miguel Santiago and Das … Read More ›

AB 886 Would Protect The Privacy Of Uber Passengers

Assembly Member Chau has pulled AB 886 from consideration. He and Consumer Federation of California are considering promising alternative strategies to protect the privacy of passengers using Uber and other so-called transportation network companies. The sensitive personal data collected by Uber, for example, includes name, address, bank account information, travel logs, as well as personal address books and online search records that it pulls from passenger smartphones. It’s becoming alarmingly common for corporations to “mine” such data and share – or sell – it to other businesses. Read More ›

California Consumer Group Seeks Enforcement Action Against Geico

by Staff, The Insurance Journal

“Our extensive analysis of Geico’s online rate quote system found that it is programmed to target unmarried low or moderate-income drivers for inflated rates,” Richard Holober, executive director of the group stated. “Targeted motorists either pay for excessive coverages they are falsely told are the lowest available, or Geico drives them away with these costly quotes. Either way, Geico is breaking California’s insurance regulations and civil rights law.” Read More ›

ConsumerWatch: Geico Accused Of Discriminatory Insurance Quotes

When was the last time your car insurance company asked about your job or if you had a college degree? On the Consumer Watch, Julie Watts says some are questioning the legality of Geico’s practices.

Geico Accused Of Discriminating Against ‘Working Class’ Customers

by Kathleen Pender, San Francisco Chronicle

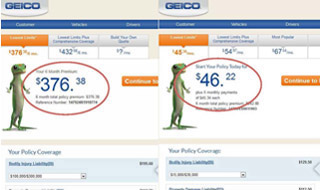

Under Proposition 103, insurance companies must offer good drivers a policy with minimum coverages of $15,000 for a single injury, $30,000 for injury to more than one person in an accident, and $5,000 for property damage, called a “15/30/5 policy.” When a “working-class” person applies online, Geico’s website shows the lowest limits are $100,000 for a single injury, $300,000 for injury to more than one person and $50,000 for property damage, the [Consumer Federation of California] said. Read More ›

GEICO Discriminates Against Unmarried Low-Income Drivers, Consumer Federation Charges

[CFC press release:] GEICO Insurance Co. illegally deceives and discriminates against unmarried, lower or moderate-income motorists by quoting them much higher minimum automobile coverage levels than permitted under state law, the Consumer Federation of California (CFC) alleges in a petition filed today with the California Department of Insurance. Having uncovered this scheme, CFC is calling on the Department of Insurance to enforce state insurance and civil rights laws by ordering GEICO to halt these practices and impose penalties. The targets of GEICO’s deceptive rate quotes are good drivers who have all of these characteristics: are unmarried, not employed in a professional or executive occupation, have not completed college, and are not currently insured. Read More ›

GEICO Rips Off Single, Lower-Income Drivers, CFC Alleges

Read CFC’s enforcement complaint here. If you’re an unmarried, uninsured good driver and have anything less than a bachelor’s degree or a professional job, GEICO quotes you coverages it claims are its “Lowest Limits” that are in fact as much as 1000% more than the minimum it … Read More ›

SB 215 Sustains Drive For CPUC Reforms Originally Sought Via SB 660

1/27/15 update: The Senate passed SB 215 (Leno) 37-0 yesterday, sending the CPUC reform bill to the Assembly. The bill includes limits on “ex parte” (private) communications that CFC had sought in SB 660, which had passed both the Senate and Assembly last fall but was vetoed by Governor … Read More ›

New Law Cracks Down On Spyware

by Michael Finney, KGO-TV San Francisco

A new law in California that took effect January 1 limits the ability of rent-to-own companies to install spyware that could monitor a customer’s every move. …”It’s outrageous, you know when you are renting a computer you’re not giving permission to the rental company to capture all the information including your emails, and even pictures of you,” said Richard Holober, Executive Director of the Consumer Federation of California. The Consumer Federation of California successfully sponsored state legislation banning the practice without first notifying the consumer. Read More ›