Category Archives: CFC in the News

Ridesharing Drivers Often Stuck In Insurance Limbo

by Alice Holbrook, NerdWallet

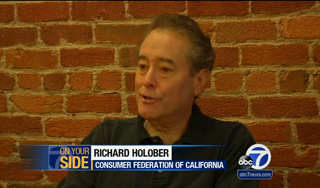

Uber executives’ access to customer ride logs came under scrutiny last year, when a company manager referenced a reporter’s log during an interview. Some users were also disturbed by Uber’s use of ride logs to compile a study on customer hookups in 2012. Critics complain that the bill would make essential functions of TNCs, like using GPS to locate passengers, illegal. But [Richard Holober, executive director of the Consumer Federation of California] likens the regulations to medical privacy laws. “Even in a hospital, not just everyone is allowed to look at your medical records.” Read More ›

Bill Would Let Companies Secretly Record Some Phone Calls

by Kathleen Pender, San Francisco Chronicle

A bill that would let companies secretly record phone calls with current or former customers for up to 20 seconds was approved by the Assembly Committee on Public Safety Tuesday. … The mockup of the bill that was passed, however, does not say that companies could only record nonconfidential information in the first 20 seconds without consent. [Consumer Federation of California Executive Director Richard] Holober sees no reason companies ever need to secretly record anything. A caller needing a 20-second preamble could simply identify himself or herself, state the nature of the call, request permission to record and then start the recording, he said. Read More ›

Firms Could Record Some Phone Calls Without Consent Under California Bill

by Sharon Bernstein, Reuters

The bill was opposed by numerous advocates for consumers and seniors, including the Consumer Federation of California and the American Civil Liberties Union. “At a time when consumers are more and more concerned about businesses invading their privacy, it is wrong to be considering rolling back an important privacy law,” said Richard Holober, executive director of the Consumer Federation of California, testifying against the bill on Tuesday. Read More ›

Calif. ‘Secret’ Phone Call Recording Bill Advances

by Kurt Orzeck, Law 360

The Consumer Federation of California on Tuesday said its executive director, Richard Holober, told the committee that AB 925’s provision for “secret recordings” would allow companies to manipulate business calls through serial phone calls, effectively defeating the purpose of the notification. The consumer group, along with the American Civil Liberties Union, California Nurses Association, California Federation of Teachers and other organizations, wrote in an Apr. 27 letter to the Assembly committee that the bill “would sacrifice well-established privacy interests. … AB 925 would eliminate an important and non-burdensome privacy protection.” Read More ›

Privacy Getting Taken For A Ride

by Samantha Gallegos, Capitol Weekly

Sponsored by the Consumer Federation of California, a non-profit consumer-rights advocacy group, [Assembly Member Ed] Chau’s bill would set up privacy standards related to “personally identifiable data” that [Transportation Network Companies] — like Uber or Lyft — would be required to follow. Those standards don’t exist now, Chau said. “I guess you could say, well, protecting some personal data is better than protecting none,” said Richard Holober, executive director of the Consumer Federation. “Right now none is protected. And I don’t believe the flawed argument that Internet-based companies should have greater freedom than the other businesses who collect and share data.” Read More ›

California Bill Would Force Uber To Guard Passenger Privacy

by Carolyn Said, San Francisco Chronicle

A bill pending in Sacramento would force Uber, Lyft and other ride-hailing companies to follow stricter privacy rules. AB886 specifies that the smartphone-ordered ride services cannot disclose any data on passengers except to combat fraud or other crimes. It also says the companies must destroy all personal information when customers cancel their accounts. “We want to put the consumers in the driver’s seat about who owns their data and personal information, instead of having them take a back seat,” said bill author Assemblyman Ed Chau. Read More ›

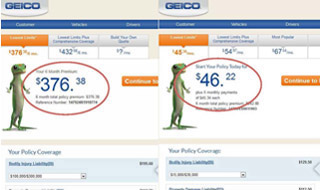

California Consumer Group Seeks Enforcement Action Against Geico

by Staff, The Insurance Journal

“Our extensive analysis of Geico’s online rate quote system found that it is programmed to target unmarried low or moderate-income drivers for inflated rates,” Richard Holober, executive director of the group stated. “Targeted motorists either pay for excessive coverages they are falsely told are the lowest available, or Geico drives them away with these costly quotes. Either way, Geico is breaking California’s insurance regulations and civil rights law.” Read More ›

ConsumerWatch: Geico Accused Of Discriminatory Insurance Quotes

When was the last time your car insurance company asked about your job or if you had a college degree? On the Consumer Watch, Julie Watts says some are questioning the legality of Geico’s practices.

Geico Accused Of Discriminating Against ‘Working Class’ Customers

by Kathleen Pender, San Francisco Chronicle

Under Proposition 103, insurance companies must offer good drivers a policy with minimum coverages of $15,000 for a single injury, $30,000 for injury to more than one person in an accident, and $5,000 for property damage, called a “15/30/5 policy.” When a “working-class” person applies online, Geico’s website shows the lowest limits are $100,000 for a single injury, $300,000 for injury to more than one person and $50,000 for property damage, the [Consumer Federation of California] said. Read More ›

New Law Cracks Down On Spyware

by Michael Finney, KGO-TV San Francisco

A new law in California that took effect January 1 limits the ability of rent-to-own companies to install spyware that could monitor a customer’s every move. …”It’s outrageous, you know when you are renting a computer you’re not giving permission to the rental company to capture all the information including your emails, and even pictures of you,” said Richard Holober, Executive Director of the Consumer Federation of California. The Consumer Federation of California successfully sponsored state legislation banning the practice without first notifying the consumer. Read More ›

The Sharing Economy: 21st Century Technology, 19th Century Worker Protections

by Amanda Armstrong, In These Times

Uber’s intensive lobbying over the summer reduced AB 2293 to a shadow of its original self. As noted by the Consumer Federation of California, in its final form the bill establishes insurance minimums far below those required of taxi, limo, and other companies that provide similar services. But the bill was flawed even at its inception, as it never sought to protect workers. AB 2293 makes drivers legally responsible for carrying liability insurance for passengers, pedestrians, and other motorists, while withholding from drivers and their family members guarantees of compensation or support in the event that they are injured or killed on the job. Read More ›

California Enacts Strict Student Privacy Law

by the Associated Press, in the San Francisco Chronicle

Gov. Jerry Brown has signed the nation’s toughest student privacy rights protections into law. SB 1177 (Steinberg) makes companies responsible for protecting any personal information that they gather from K-12 students through websites, online applications and other services. The data can be used only for school purposes, and students’ personal information cannot be sold. Consumer Federation of California Executive Director Richard Holober called the law “the vanguard for consumer rights in the digital era. Until this point, protecting students’ online information has been a Wild West.” Read More ›

Gov. Brown Toughens Rules on Senior Residential Care Facilities

by Patrick McGreevey, Los Angeles Times

Gov. Jerry Brown on Sunday approved sweeping new rules for residential care facilities aimed at protecting senior citizens from substandard conditions. The governor approved nine bills that his office said in a statement are meant to “protect the health and safety of seniors residing in assisted living facilities across the state.” Read More ›