Category Archives: Latest In Consumer News

Overdraft Practices Continue To Gut Bank Accounts And Haunt Customers

by Michael Corkery and Jessica Silver-Greenberg, New York Times

The nation’s big consumer banks collected about $11 billion in overdraft fees last year, which accounted for 8 percent of their profits, according to a report by the Consumer Financial Protection Bureau. … Many customers end up confused by how overdrafts work. In their marketing materials, for example, banks present the choice of whether to sign up for overdraft as an offer of “overdraft protection” — a feature many customers thought would automatically deny transactions and shield them from incurring the fees at all. In reality, it is a service authorizing the banks to charge the overdraft fees. Read More ›

Judge Asked To Fine PG&E $112 Million For Carmel Blast

by Jaxon Van Derbeken, San Francisco Chronicle

“PG&E should be reminded that the commission and its staff are not operating on a ‘need-to-know’ basis with PG&E,” [Ed Moldavsky, an attorney for CPUC’s safety division,] wrote in his recommendation. … “PG&E has a duty to disclose even troubling facts to the commission,” Moldavsky wrote. “PG&E’s failure to do so makes a mockery out of the regulatory compact.” … “How many times does the corporate mule need to be hit over the head with a 2-by-4 to get its attention?” [Carmel] city attorneys asked. … “Yet here we are again. The facts are clear, and the law is clear.” Read More ›

Federal Efforts In Data Privacy Move Slowly

by Natasha Singer, New York Times

After Congress failed to take up baseline consumer privacy legislation, the [Obama] administration issued its own discussion draft of a bill last year. … Consumer advocates are not holding their breath, although some are turning to the states to enact consumer privacy protections for technologies like facial recognition, voice-controlled smart TVs and social media services. “An individual should have control over their information,” said Jeffrey Chester, the executive director of the Center for Digital Democracy, a nonprofit group in Washington, “not a Facebook, Google or Internet service provider.” Read More ›

UC Berkeley Breach: Universities Increasingly Targeted By Cyberattacks

by Henry Gass, Christian Science Monitor

From 2013 to 2015, 550 universities reported some kind of data breach, NBC reported last fall, and in 2014 only the health care and retail sectors reported more security breaches than the education sector, according to Symantec’s Internet Security Threat Report. … A number of factors make its particularly hard for colleges and universities to defend against cyberattacks. First, the transient nature of the student body means new devices are constantly entering and leaving the university system. Read More ›

Who’s Regulating For-Profit Schools? Execs From For-Profit Colleges

by Annie Waldman, ProPublica

We looked at all [Accrediting Council for Independent Colleges and Schools] commissioners since 2010 and found that two-thirds of them have worked as executives at for-profit schools while sitting on the council. A third of the commissioners came from schools that have been facing consumer-protection lawsuits, investigations by state attorneys general, or federal financial monitoring. … Consider Beth Wilson. Wilson, the executive vice president of Corinthian Colleges, joined ACICS in 2014, less than three months after the California attorney general had filed a lawsuit against Corinthian for … Read More ›

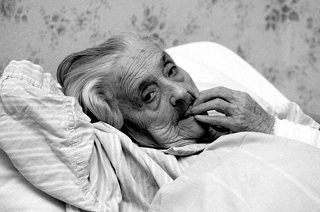

Abandoned Nursing Home Residents Live Months In Hospital, Waiting

by Anna Gorman, KQED

Nursing home residents are entitled to hearings under federal law to determine whether they should be readmitted after hospitalization. The state Department of Health Care Services holds the administrative hearings, but has said it is not responsible for enforcing the rulings. But the state Department of Public Health, which oversees nursing homes, neglects to enforce the rulings and sometimes disagrees with them, according to advocates and court documents. … And since many nursing home residents have publicly-funded insurance, it means taxpayers are on the hook for hospital stays long after the patients are ready for discharge. Read More ›

Police Agencies Tap Secret Cellphone System

by Teri Sforza and Lily Leung, The Orange County Register

The devices mimic wireless telecommunications towers and can trick cellphones into connecting to them rather than the towers. Police then can collect data from the phones, including phone numbers and GPS points. Their use has grown increasingly controversial, particularly as it has spread from federal to local agencies. … “My concern is whether there are sufficient safeguards to ensure the protection of privacy with regard to this technology,” said Erwin Chemerinsky, a constitutional law scholar and dean of UC Irvine’s School of Law. “Public knowledge of this technology is an essential first step.” Read More ›

The Conflict Between Apple And The FBI Has A Long History – And Your Privacy Is At Stake

by Michael Hiltzik, Los Angeles Times

American consumers are becoming more sensitive to the potential for technological invasions of their privacy. Revelations of government spying on phone conversations, made by whistleblowers such as Edward Snowden, and of prosecutors’ overreaching have sharpened the tech community’s sense that weakened security threatens the privacy of the average citizen more than it aids law-enforcement—and also sharpened suspicions of government motivations. Read More ›

Ability To Opt Out Uncertain In Lawsuit Requiring Student Data Release

by Theresa Harrington, EdSource

A judge’s order requiring the California Department of Education to release personal data for 10 million students as a result of a lawsuit over special education rights does not state whether parents’ objections will automatically trigger the removal of their children’s records from disclosure. … Public outcry over the data release prompted three state legislators to propose AB 2097 on Wednesday, which would “ensure that students’ personal information, like Social Security numbers, are appropriately protected.” Read More ›

How Apple Ended Up In The Government’s Encryption Crosshairs

by Brandon Bailey and Michael Liedtke, The Associated Press

[The Center for Democracy and Technology, which has criticized government surveillance,] warned that other companies could face similar orders in the future. Others said a government victory could encourage regimes in China and other countries to make similar requests for access to smartphone data. … “This case is going to affect everyone’s privacy and security around the world,” said Lee Tien, a staff attorney for the Electronic Frontier Foundation, a digital rights group in San Francisco. Read More ›

The Pink Tax: Why Women’s Products Often Cost More

by Susan Johnston Taylor, U.S. News & World Report

According to a study of gendered pricing released by New York City Department of Consumer Affairs last year, shampoo and conditioner marketed to women cost an average of 48 percent more than those marketed to men, while women’s jeans cost 10 percent more than men’s, and girls’ bikes and scooters cost 6 percent more than boys’. Overall, the study found that products marketed to women cost more 42 percent of the time. … Some items marketed to women not only cost more but actually contain less of the product because manufacturers make the product smaller and more feminine-looking. Read More ›

Uber Agrees To Settle Class-Action Suit Over Safety Claims

by Mike Isaac, New York TImes

Uber has agreed to pay $28.5 million to settle a class-action lawsuit that took issue with the company’s claims that its driver background checks were “industry leading.” The terms of the settlement, filed on Thursday in the United States District Court in the Northern District of California, require Uber to pay roughly 25 million riders across the United States … Uber passengers who used the service in the United States between Jan. 1, 2013, and Jan. 31, 2016, will be notified by email and have the option to accept a refund in the form of a rider credit or a charge back to their credit card on file. Read More ›

CNIL Gives Facebook Three Months To Comply With Privacy Order

by Jedidiah Bracy, International Association of Privacy Professionals

French data protection authority CNIL sent a formal notice to the social networking giant that it was violating the nation’s privacy law and now has three months to get into compliance. Read More ›