Tag Archives: CFPB

CFPB Stretches Bank Rules to Cover Prepaid Cards, Mobile Payments

by Sheryl Harris, The Plain Dealer (Cleveland, Ohio)

“Many of these prepaid consumers are living paycheck to paycheck, and are engaged in a constant battle to make ends meet,” said CFPB Director Richard Cordray in remarks prepared for a field hearing Thursday. “They are some of the most economically vulnerable among us, and most of them have no idea that the prepaid cards they choose to purchase are largely unregulated.” … Many prepaid card issuers broadened consumer protections and trimmed fees as they came under increased scrutiny from the bureau. Read More ›

CFPB Finds Older Consumers Face Illegal, Harassing Tactics from Debt Collectors

by Ashlee Kieler, Consumerist

A new report from the Consumer Financial Protection Bureau shines light on the issues older consumers face when it comes to their financial well-being. According to the report, which looked at older consumers’ complaints filed with the CFPB between July 2013 to September 2014, the number one issue Americans 62 years of age and older faced involved their experiences with debt collectors. The CFPB issued a consumer advisory including tips for older Americans faced with debt collection. Read More ›

The CFPB has only just begun tackling financial services in its first four years

by Ashlee Kieler, Consumerist

Four years ago, the Consumer Financial Protection Bureau was created as a safeguard to ensure the financial industry followed the rules when selling products and services to consumers – and a lot has happened since that time. From returning billions of dollars to consumers who were wrong by financial services to holding for-profit colleges accountable for their deceptions, the work of the CFPB has touched many areas of the financial world and it continues to expand. While the CFPB has provided assistance to millions of consumers in its short time, there is undoubtedly more issues to be addressed. Read More ›

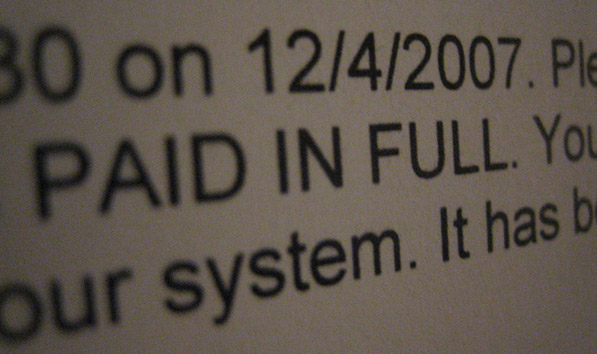

Nasty surprise for some student loan borrowers

by Herb Weisbaum, CNBC

Students who take out private loans to pay for college could face a nasty surprise if their co-signer dies or files for bankruptcy: The lender may suddenly demand the loan be paid in full—or even worse, put that loan in default—even though all payments are being made on time. The Consumer Financial Protection Bureau issued a consumer advisory on Tuesday, warning borrowers that these “auto-default” clauses may be in their loan agreements and serious financial consequences could result. Read More ›