Tag Archives: GEICO

CFC Saved Drivers Over $15 Million On Insurance In 2015

Hartford and Safeco had both sought to boost auto insurance rates by almost 7%, but CFC challenged the rate hike proposals. The result: $5 million in auto policy savings for Hartford customers and $10 million for Safeco customers. In August, GEICO agreed to pay $6 million to settle CFC’s complaint alleging the insurance giant violated civil rights and insurance law by targeting women and unmarried, lower-income motorists with deceptive and inflated automobile insurance rate quotes. It is difficult to calculate motorists’ potential savings resulting from the settlement, but CFC estimates it may reach several million dollars annually. Read More ›

Auto Insurance Company GEICO Pays Out Multi-Million Dollar Settlement

by Tom Vacar, Fox 2 (KTVU Oakland)

The Consumer Federation of California charges that GEICO tried to discourage less preferable customers. Those include those not college-educated, not professional, not executive, a woman, an unmarried person, or those not currently insured. They would not be offered those lowest legal minimum [rates]. Read More ›

Geico Pays $6M To Settle Insurance Discrimination Claim

by Kathleen Pender, San Francisco Chronicle

Geico will pay $6 million to settle a complaint alleging it illegally discriminated against women, unmarried people, blue-collar workers and those without four-year college degrees by showing them costlier auto insurance policies on its Web site than it showed other potential customers. “We believe the primary intent was to drive these folks away from Geico to someone else’s Web site or at least make sure they were paying a lot more money if they didn’t drive them away,” said Richard Holober, executive director of the Consumer Federation of America, the nonprofit advocacy group that filed the complaint. Read More ›

Geico Agrees To $6-Million Settlement In Discriminatory Pricing Case

by Nick Shively, Los Angeles Times

The agreement stems from a petition filed by the Consumer Federation of California asking the department to take action against the Chevy Chase, Md.-based insurer on the grounds that it was discriminating based on occupation, education level and other personal characteristics. The federation had tested Geico’s website and found the insurer misrepresented information for customers who were unmarried, unemployed or employed in a low-wage occupation, had not obtained a four-year college degree and had gaps in insurance coverage, according to the petition documents. Read More ›

GEICO Pays $6 Million To Settle CFC Civil Rights, Deceptive Rate Quote Complaints

GEICO agreed to pay $6 million to settle a Consumer Federation of California complaint alleging the insurance giant violated civil rights and insurance laws by targeting low- and moderate-income women and unmarried motorists with deceptive and inflated automobile insurance rate quotes. “This is an important win for all California motorists,” said CFC Executive Director Richard Holober. “GEICO is paying a price for its unfair practices, and the settlement assures that all good drivers are treated equally, whether rich, poor, or in between. It sets a new industry standard for rate quotes that are accurate and transparent.” Read More ›

California Consumer Group Seeks Enforcement Action Against Geico

by Staff, The Insurance Journal

“Our extensive analysis of Geico’s online rate quote system found that it is programmed to target unmarried low or moderate-income drivers for inflated rates,” Richard Holober, executive director of the group stated. “Targeted motorists either pay for excessive coverages they are falsely told are the lowest available, or Geico drives them away with these costly quotes. Either way, Geico is breaking California’s insurance regulations and civil rights law.” Read More ›

ConsumerWatch: Geico Accused Of Discriminatory Insurance Quotes

When was the last time your car insurance company asked about your job or if you had a college degree? On the Consumer Watch, Julie Watts says some are questioning the legality of Geico’s practices.

Geico Accused Of Discriminating Against ‘Working Class’ Customers

by Kathleen Pender, San Francisco Chronicle

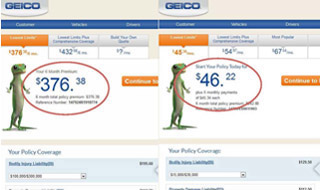

Under Proposition 103, insurance companies must offer good drivers a policy with minimum coverages of $15,000 for a single injury, $30,000 for injury to more than one person in an accident, and $5,000 for property damage, called a “15/30/5 policy.” When a “working-class” person applies online, Geico’s website shows the lowest limits are $100,000 for a single injury, $300,000 for injury to more than one person and $50,000 for property damage, the [Consumer Federation of California] said. Read More ›

GEICO Discriminates Against Unmarried Low-Income Drivers, Consumer Federation Charges

[CFC press release:] GEICO Insurance Co. illegally deceives and discriminates against unmarried, lower or moderate-income motorists by quoting them much higher minimum automobile coverage levels than permitted under state law, the Consumer Federation of California (CFC) alleges in a petition filed today with the California Department of Insurance. Having uncovered this scheme, CFC is calling on the Department of Insurance to enforce state insurance and civil rights laws by ordering GEICO to halt these practices and impose penalties. The targets of GEICO’s deceptive rate quotes are good drivers who have all of these characteristics: are unmarried, not employed in a professional or executive occupation, have not completed college, and are not currently insured. Read More ›

GEICO Rips Off Single, Lower-Income Drivers, CFC Alleges

Read CFC’s enforcement complaint here. If you’re an unmarried, uninsured good driver and have anything less than a bachelor’s degree or a professional job, GEICO quotes you coverages it claims are its “Lowest Limits” that are in fact as much as 1000% more than the minimum it … Read More ›

Leaked Transcript Shows Geico’s Stance Against Uber, Lyft

by Carolyn Said, San Francisco Chronicle

The largest insurer, State Farm, said it would not cover ride-service activities. “We do not insure livery use, therefore, customers should not depend on their personal auto insurance coverage to protect them while driving for a ride-sharing service like Uber or Lyft,” State Farm spokesman Sevag Sarkissian wrote in an e-mail. “A commercial auto insurance policy is needed to insure against livery use exposures.” Allstate, the third-largest, has a similar policy. Read More ›

As data about drivers proliferates, auto insurers look to adjust rates

by Alina Tugend, New York Times

It’s no surprise that car accidents, speeding tickets and where you live all affect how much you pay for automobile insurance. But consumer groups say that other, apparently unrelated, factors are unfairly being used to set rates. Two organizations have released separate reports contending that the factors insurance companies are using to determine rates — like educational level and occupation — are detrimental to consumers, especially to low-income customers. Read More ›