Tag Archives: Senior Issues

Con Artist Exploits A Grandmother’s Love Of Family

by Nancy Peverini, commentary in The Sacramento Bee

Even though the plot was foiled, it destroyed my mother’s sense of independence. She felt guilty and embarrassed – a common reaction that allows these scams to continue because many of our elderly do not want others to know that they fell for a scam. … We need to ring the bell more so our parents will be protected. According to some estimates, seniors account for 30 percent of all financial fraud. Consumer groups have tips to avoid getting ripped off. …Definitely don’t provide your credit card information. Read More ›

California’s Largest Nursing Home Owner Under Fire From Government Regulators

Since 2006, [Shlomo] Rechnitz and his primary company, Brius Healthcare Services, have acquired 81 nursing homes up and down the state, many of them through bankruptcy court. His chain has grown so quickly that he now controls about 1 in every 14 nursing home beds in California, giving him an outsized influence on quality of care in the state. … Between October and January, three of Rechnitz’s facilities, including South Pasadena, were decertified by the federal government, an economic kiss of death that is extremely rare. The punishment strips a nursing home of its crucial Medicare funding until it can demonstrate improvement, or is closed or sold. Read More ›

Price Of A Common Surgery Varies From $39,000 To $237,000 In L.A.

by Chad Terhune and Sandra Poindexter, Los Angeles Times

The average charge nationwide for a major joint replacement operation was $54,239, according to federal figures. Joint replacement surgeries are Medicare’s most common inpatient procedure, costing the federal government more than $6.6 billion in 2013. Overall, the latest data show what hospitals charged and what Medicare paid for 100 of the most common inpatient stays and the 30 most common outpatient procedures. The inpatient data cover more than $62 billion of Medicare money. Read More ›

CFC Sponsors Bill To Protect Seniors From Unethical Long-Term Care Referral Agencies

SACRAMENTO – The Consumer Federation of California (CFC) is sponsoring Senate Bill 648 (Mendoza, D-Artesia) to increase disclosure requirements and strengthen oversight of private placement agencies that refer seniors to residential care facilities for the elderly (RCFEs). Read More ›

Debt Collectors Hound Millions Of Retired Americans

by Herb Weisbaum, NBCNews.com

The CFPB report noted that some of the seniors who complained about debt collectors expressed concern that “the distress of being harassed by a debt collector aggravates existing medical conditions and thereby endangers their health.” … The CFPB advisory has sample letters that can be used to find out information about the claims being made, dispute the debt and request that a debt collector stops collection communications. If you are having a problem with a debt collector, you can file a complaint with the CFPB. Read More ›

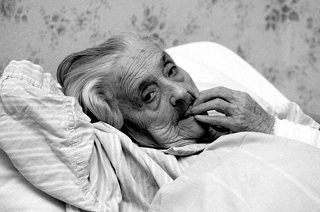

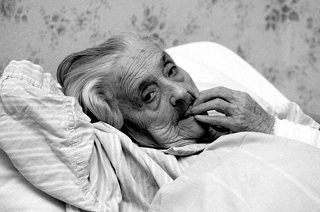

Nursing Homes Rarely Penalized For Oversedating Patients

by Ina Jaffe, Robert Benincasa, National Public Radio

NPR’s analysis [of federal data] found that harsh penalties are almost never used when nursing home residents get unnecessary drugs of any kind. … The agency’s new goal for nursing homes is an additional 15 percent reduction in antipsychotic drug use by the end of 2016. But even if that goal is met, it will mean that after a five-year effort, almost a quarter of a million nursing home residents will still be getting largely unnecessary and potentially lethal antipsychotic drugs. Read More ›

Why You Shouldn’t Get a Reverse Mortgage Just Because Fred Thompson Tells You to

by Ashlee Kieler, Consumerist

Reverse mortgages have been found to leave families with debts they can never repay, four-in-five payday loans are made to consumers already caught in the debt trap, and on average 54% of students who attend a for-profit college leave without a degree — with one-in-five of those students defaulting on their loans. … Consumers Union, along with California Advocates for Nursing Home Reform provided comments to the Consumer Financial Protection Bureau regarding consumers’ use of reverse mortgages. Read More ›

Unmasked: How California’s Largest Nursing Home Chains Perform

by Marjie Lundstrom and Phillip Reese, The Sacramento Bee

Knowing who owns what can be critical for fragile patients seeking long-term care, according to a Sacramento Bee investigation, which analyzed thousands of federal and state records detailing the ownership of the state’s 1,260 nursing homes. In addition to identifying owners with at least a 5 percent stake in any California-based facility, The Bee also examined government and industry data to determine how the largest owners and their facilities performed on 46 measures, including quality-of-care indicators, staffing, complaints and deficiencies found during inspections. Read More ›

CFPB Finds Older Consumers Face Illegal, Harassing Tactics from Debt Collectors

by Ashlee Kieler, Consumerist

A new report from the Consumer Financial Protection Bureau shines light on the issues older consumers face when it comes to their financial well-being. According to the report, which looked at older consumers’ complaints filed with the CFPB between July 2013 to September 2014, the number one issue Americans 62 years of age and older faced involved their experiences with debt collectors. The CFPB issued a consumer advisory including tips for older Americans faced with debt collection. Read More ›

Brown Signs Package of Assisted-Living Reform Bills

by Deborah Schoch, The CHCF Center for Health Reporting / The California Report

Brown’s signature is a major victory for assisted living residents, “We look at it as a good start,” said Patricia McGinnis, executive director of California Advocates for Nursing Home Reform. “But we’re not finished by any stretch of the imagination. And I don’t think the legislators are, either. I think they like the fact that they’re going to be changing people’s lives on an immediate basis.” The governor has approved all 13 assisted living bills passed by the Legislature. Read More ›

Gov. Brown Toughens Rules on Senior Residential Care Facilities

by Patrick McGreevey, Los Angeles Times

Gov. Jerry Brown on Sunday approved sweeping new rules for residential care facilities aimed at protecting senior citizens from substandard conditions. The governor approved nine bills that his office said in a statement are meant to “protect the health and safety of seniors residing in assisted living facilities across the state.” Read More ›

Some Assisted-Care Safeguards For Seniors Advance

An ambitious drive to protect seniors living in residential care facilities for the elderly continues to progress through the committee process as the Legislature works toward its summer recess, scheduled to begin July 4. The action is in Sacramento, but the impetus comes from families around the state. Read More ›

Report: Student Loan Debt Isn’t Just An Issue For Young Americans

by Ashlee Kieler, Consumerist

A new report from the Government Accountability Office found that 3 percent of households headed by those ages 65 years or older carry student loan debt, totaling $18.2 billion in 2013. Nearly a quarter of older Americans’ loans are in default – which often leaves the retirees living below the poverty threshold. One California resident told a recent Senate Aging Committee hearing she might be well into her 80s before she pays off her student loans, and she now worries that her Social Security benefits will decline to make payments on the debt. Read More ›