Tag Archives: Deceptive

More Auto Title Lenders Are Snagging Unwary Borrowers In Cycle Of Debt

by Jim Puzzanghera, Los Angeles Times

“I look at title lending as legalized car thievery,” said Rosemary Shahan, president of Consumers for Auto Reliability and Safety, a Sacramento advocacy group. “What they want to do is get you into a loan where you just keep paying, paying, paying, and at the end of the day, they take your car.” … In California, the number of auto title loans jumped to 91,505 in 2013, the latest data available, from 64,585 in the previous year and 38,148 in the first year, 2011, that was tracked by the state Department of Business Oversight. Read More ›

American Chemistry Council Lied About Lobbying Role On Flame Retardants, Consultant Says

by David Heath, The Daily Beast

The American Chemistry Council has long maintained that it had nothing to do with an enormously successful but deceitful lobbying effort in state capitals to defend the use of potentially ineffective and toxic flame retardants in furniture. Now, in a rare breaking of ranks, a top industry consultant is discrediting that story. … He stepped up to a microphone at a California State Senate hearing to announce his support for a bill [CFC-co-sponsored SB 763] requiring labeling of children’s products containing the chemicals. Read More ›

Firms Could Record Some Phone Calls Without Consent Under California Bill

by Sharon Bernstein, Reuters

The bill was opposed by numerous advocates for consumers and seniors, including the Consumer Federation of California and the American Civil Liberties Union. “At a time when consumers are more and more concerned about businesses invading their privacy, it is wrong to be considering rolling back an important privacy law,” said Richard Holober, executive director of the Consumer Federation of California, testifying against the bill on Tuesday. Read More ›

Calif. ‘Secret’ Phone Call Recording Bill Advances

by Kurt Orzeck, Law 360

The Consumer Federation of California on Tuesday said its executive director, Richard Holober, told the committee that AB 925’s provision for “secret recordings” would allow companies to manipulate business calls through serial phone calls, effectively defeating the purpose of the notification. The consumer group, along with the American Civil Liberties Union, California Nurses Association, California Federation of Teachers and other organizations, wrote in an Apr. 27 letter to the Assembly committee that the bill “would sacrifice well-established privacy interests. … AB 925 would eliminate an important and non-burdensome privacy protection.” Read More ›

L.A. Sues Wells Fargo, Alleging ‘Unlawful And Fraudulent Conduct’

by E. Scott Reckard, Los Angeles Times

The civil complaint, filed Monday in state court in Los Angeles by City Atty. Mike Feuer, says the largest California-based bank encouraged its employees to engage “in unfair, unlawful and fraudulent conduct” through a pervasive culture of high-pressure sales. Employees misused customers’ confidential information and often failed to close unauthorized accounts even when customers complained, the suit alleges. … In addition to charging fees on unwanted accounts, San Francisco-based Wells Fargo harmed customers by placing them into collections based on unauthorized withdrawals and reported damaging information on their credit reports … Read More ›

CFC Sponsors Bill To Protect Seniors From Unethical Long-Term Care Referral Agencies

SACRAMENTO – The Consumer Federation of California (CFC) is sponsoring Senate Bill 648 (Mendoza, D-Artesia) to increase disclosure requirements and strengthen oversight of private placement agencies that refer seniors to residential care facilities for the elderly (RCFEs). Read More ›

California Consumer Group Seeks Enforcement Action Against Geico

by Staff, The Insurance Journal

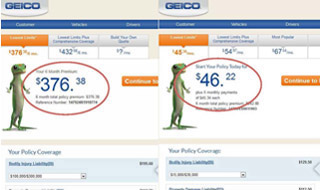

“Our extensive analysis of Geico’s online rate quote system found that it is programmed to target unmarried low or moderate-income drivers for inflated rates,” Richard Holober, executive director of the group stated. “Targeted motorists either pay for excessive coverages they are falsely told are the lowest available, or Geico drives them away with these costly quotes. Either way, Geico is breaking California’s insurance regulations and civil rights law.” Read More ›

ConsumerWatch: Geico Accused Of Discriminatory Insurance Quotes

When was the last time your car insurance company asked about your job or if you had a college degree? On the Consumer Watch, Julie Watts says some are questioning the legality of Geico’s practices.

Geico Accused Of Discriminating Against ‘Working Class’ Customers

by Kathleen Pender, San Francisco Chronicle

Under Proposition 103, insurance companies must offer good drivers a policy with minimum coverages of $15,000 for a single injury, $30,000 for injury to more than one person in an accident, and $5,000 for property damage, called a “15/30/5 policy.” When a “working-class” person applies online, Geico’s website shows the lowest limits are $100,000 for a single injury, $300,000 for injury to more than one person and $50,000 for property damage, the [Consumer Federation of California] said. Read More ›

GEICO Discriminates Against Unmarried Low-Income Drivers, Consumer Federation Charges

[CFC press release:] GEICO Insurance Co. illegally deceives and discriminates against unmarried, lower or moderate-income motorists by quoting them much higher minimum automobile coverage levels than permitted under state law, the Consumer Federation of California (CFC) alleges in a petition filed today with the California Department of Insurance. Having uncovered this scheme, CFC is calling on the Department of Insurance to enforce state insurance and civil rights laws by ordering GEICO to halt these practices and impose penalties. The targets of GEICO’s deceptive rate quotes are good drivers who have all of these characteristics: are unmarried, not employed in a professional or executive occupation, have not completed college, and are not currently insured. Read More ›

GEICO Rips Off Single, Lower-Income Drivers, CFC Alleges

Read CFC’s enforcement complaint here. If you’re an unmarried, uninsured good driver and have anything less than a bachelor’s degree or a professional job, GEICO quotes you coverages it claims are its “Lowest Limits” that are in fact as much as 1000% more than the minimum it … Read More ›

iPhone Users Sue Claiming False Advertising, Cloud Storage Hawking

by Laura Northrup, Consumerist

The iPhone users’ attorneys claim that users aren’t told how much of their already meager storage capacity they will lose when upgrading their phone’s operating system. “Apple fails to disclose that upgrading from iOS 7 to iOS 8 will cost a Device user between 600 MB and 1.3 GB of storage space – a result that no consumer could reasonably anticipate,” they point out. … Once space runs out, the iDevice asks the user whether they’d like to rent some additional iCloud space. “For this service, Apple charges prices ranging from $0.99 to $29.99 per month,” the complaint notes. Read More ›

CFPB Lawsuit: Sprint Made Millions Off Consumers Acting As A “Breeding Ground” For Bill-Cramming

by Ashlee Kieler, Consumerist

The CFPB reports that most affected Sprint customers were initially targeted by the third-party products online. “Consumers clicked on ads that brought them to websites asking them to enter their cellphone numbers,” officials with the CFPB say in a news release. “Some merchants tricked consumers into providing their cellphone numbers to receive ‘free’ digital content and then charged for it. Many others simply placed fabricated charges on bills without delivering any goods or communicating with consumers.” Read More ›