Tag Archives: Intervenor

Auto Insurance Company GEICO Pays Out Multi-Million Dollar Settlement

by Tom Vacar, Fox 2 (KTVU Oakland)

The Consumer Federation of California charges that GEICO tried to discourage less preferable customers. Those include those not college-educated, not professional, not executive, a woman, an unmarried person, or those not currently insured. They would not be offered those lowest legal minimum [rates]. Read More ›

Geico Pays $6M To Settle Insurance Discrimination Claim

by Kathleen Pender, San Francisco Chronicle

Geico will pay $6 million to settle a complaint alleging it illegally discriminated against women, unmarried people, blue-collar workers and those without four-year college degrees by showing them costlier auto insurance policies on its Web site than it showed other potential customers. “We believe the primary intent was to drive these folks away from Geico to someone else’s Web site or at least make sure they were paying a lot more money if they didn’t drive them away,” said Richard Holober, executive director of the Consumer Federation of America, the nonprofit advocacy group that filed the complaint. Read More ›

California Consumer Group Seeks Enforcement Action Against Geico

by Staff, The Insurance Journal

“Our extensive analysis of Geico’s online rate quote system found that it is programmed to target unmarried low or moderate-income drivers for inflated rates,” Richard Holober, executive director of the group stated. “Targeted motorists either pay for excessive coverages they are falsely told are the lowest available, or Geico drives them away with these costly quotes. Either way, Geico is breaking California’s insurance regulations and civil rights law.” Read More ›

ConsumerWatch: Geico Accused Of Discriminatory Insurance Quotes

When was the last time your car insurance company asked about your job or if you had a college degree? On the Consumer Watch, Julie Watts says some are questioning the legality of Geico’s practices.

Geico Accused Of Discriminating Against ‘Working Class’ Customers

by Kathleen Pender, San Francisco Chronicle

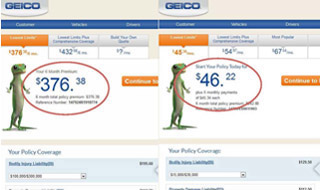

Under Proposition 103, insurance companies must offer good drivers a policy with minimum coverages of $15,000 for a single injury, $30,000 for injury to more than one person in an accident, and $5,000 for property damage, called a “15/30/5 policy.” When a “working-class” person applies online, Geico’s website shows the lowest limits are $100,000 for a single injury, $300,000 for injury to more than one person and $50,000 for property damage, the [Consumer Federation of California] said. Read More ›

GEICO Rips Off Single, Lower-Income Drivers, CFC Alleges

Read CFC’s enforcement complaint here. If you’re an unmarried, uninsured good driver and have anything less than a bachelor’s degree or a professional job, GEICO quotes you coverages it claims are its “Lowest Limits” that are in fact as much as 1000% more than the minimum it … Read More ›

CFC: $148 Million In Insurance Savings For Ratepayers

Last year, CFC began intervening before the Department of Insurance in Prop 103 auto and homeowner insurance rate reviews. Our actuaries scrutinized data submitted by insurers, pointed out errors in calculations or loss projections, and persuaded regulators and insurers to cut their proposed rate increases. As a … Read More ›

We Saved Consumers $125 Million On Insurance So Far In 2014

by Richard Holober, Executive Director, Consumer Federation of California

10/1/2014 Update: 2014 consumer savings rose to $148.3 million by year’s end. To recap: 1 million AIG policyholders saved $7.7 million on homeowners insurance. Infinity Insurance policyholders saved $15.5 million on auto insurance. 1.2 million Farmers policyholders saved $34 million on homeowners insurance (details below). 1.6 million … Read More ›

Consumer Federation saves California homeowners $34 million

Using California’s longstanding consumer protection laws, known as Proposition 103, CFC worked with Farmers and the California Department of Insurance to cut the increase nearly by half, resulting in an overall savings of about $34 million. Read More ›

State Auditor vindicates CPUC Intervenor Compensation Program

The California State Auditor released a favorable report – surely to the dismay of AT&T, Verizon and PG&E – that reviewed intervenor compensation awarded to advocacy groups participating. The program provides consumers an effective voice before state regulators when utilities seek unwarranted rate hikes or rules that harm ratepayers. Read More ›