Tag Archives: Ripoff Clause

The nursing home industry’s war to deny patients their day in court

by F. Paul Bland, Jr., The Legal Examiner

Arbitration is nothing like going to court. Arbitration takes place outside of a courtroom, without a judge, without a jury, and with limited opportunity to seek or present evidence. What’s more, the proceedings are entirely confidential and are often presided over by arbitrators paid for by the defendant. Read More ›

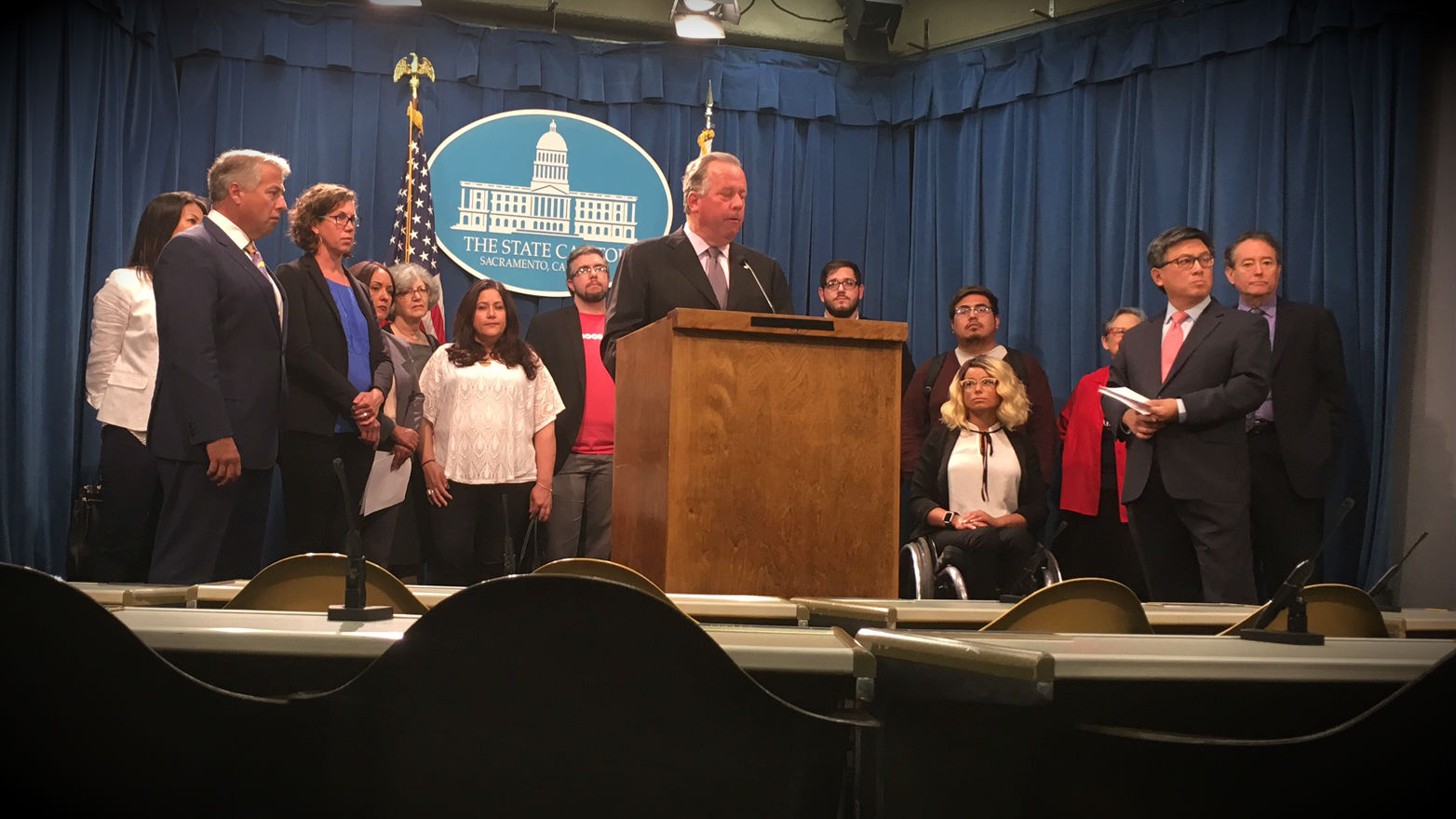

Legislation introduced to address Wells Fargo scandal

“Wells Fargo’s customers were ripped off twice,” said Richard Holober, Executive Director of Consumer Federation of California. “First, the bank created two million fraudulent accounts. Then when consumers tried to sue, the bank forced them into company-dominated arbitration hearings. SB 33 will guarantee that the victims of a bank’s identity theft will get their day in court.” Read More ›

Talks begin over bill inspired by Wells Fargo scandal

by Dominic Fracassa, San Francisco Chronicle

Legislative deliberations continued Tuesday over a bill that seeks to prevent financial institutions accused of defrauding their customers from pulling legal disputes out of the state court system and into private arbitration. Read More ›

California bill seeks to help fraud victims of banks

[Senate Bill 33] would help victims of fraud committed by their financial institution after thousands of Americans fell victim to a Wells Fargo scandal. Read More ›

Wells Fargo To Pay $185 million Settlement For ‘Outrageous’ Sales Culture

by James Rufus Koren, Los Angeles Times

Calling it “outrageous” and “a major breach of trust,” local and federal regulators hammered Wells Fargo & Co. for a pervasive culture of aggressive sales goals that pushed thousands of workers to open as many as 2 million accounts that bank customers never wanted. Read More ›

Wells Fargo Identity Theft Racket Inspired SB 33 (Dodd): Justice for Victims

October 4 Update: Jerry Brown signed SB 33 into law. The Consumer Federation of California is co-sponsoring legislation by State Senator Bill Dodd (D-Napa) inspired by Wells Fargo’s fraudulent creation of two million customer accounts. Senate Bill 33 will make sure that in the future, victims of … Read More ›