Tag Archives: Scams

Geico Pays $6M To Settle Insurance Discrimination Claim

by Kathleen Pender, San Francisco Chronicle

Geico will pay $6 million to settle a complaint alleging it illegally discriminated against women, unmarried people, blue-collar workers and those without four-year college degrees by showing them costlier auto insurance policies on its Web site than it showed other potential customers. “We believe the primary intent was to drive these folks away from Geico to someone else’s Web site or at least make sure they were paying a lot more money if they didn’t drive them away,” said Richard Holober, executive director of the Consumer Federation of America, the nonprofit advocacy group that filed the complaint. Read More ›

Geico Agrees To $6-Million Settlement In Discriminatory Pricing Case

by Nick Shively, Los Angeles Times

The agreement stems from a petition filed by the Consumer Federation of California asking the department to take action against the Chevy Chase, Md.-based insurer on the grounds that it was discriminating based on occupation, education level and other personal characteristics. The federation had tested Geico’s website and found the insurer misrepresented information for customers who were unmarried, unemployed or employed in a low-wage occupation, had not obtained a four-year college degree and had gaps in insurance coverage, according to the petition documents. Read More ›

GEICO Pays $6 Million To Settle CFC Civil Rights, Deceptive Rate Quote Complaints

GEICO agreed to pay $6 million to settle a Consumer Federation of California complaint alleging the insurance giant violated civil rights and insurance laws by targeting low- and moderate-income women and unmarried motorists with deceptive and inflated automobile insurance rate quotes. “This is an important win for all California motorists,” said CFC Executive Director Richard Holober. “GEICO is paying a price for its unfair practices, and the settlement assures that all good drivers are treated equally, whether rich, poor, or in between. It sets a new industry standard for rate quotes that are accurate and transparent.” Read More ›

Con Artist Exploits A Grandmother’s Love Of Family

by Nancy Peverini, commentary in The Sacramento Bee

Even though the plot was foiled, it destroyed my mother’s sense of independence. She felt guilty and embarrassed – a common reaction that allows these scams to continue because many of our elderly do not want others to know that they fell for a scam. … We need to ring the bell more so our parents will be protected. According to some estimates, seniors account for 30 percent of all financial fraud. Consumer groups have tips to avoid getting ripped off. …Definitely don’t provide your credit card information. Read More ›

ConsumerWatch: Geico Accused Of Discriminatory Insurance Quotes

When was the last time your car insurance company asked about your job or if you had a college degree? On the Consumer Watch, Julie Watts says some are questioning the legality of Geico’s practices.

Geico Accused Of Discriminating Against ‘Working Class’ Customers

by Kathleen Pender, San Francisco Chronicle

Under Proposition 103, insurance companies must offer good drivers a policy with minimum coverages of $15,000 for a single injury, $30,000 for injury to more than one person in an accident, and $5,000 for property damage, called a “15/30/5 policy.” When a “working-class” person applies online, Geico’s website shows the lowest limits are $100,000 for a single injury, $300,000 for injury to more than one person and $50,000 for property damage, the [Consumer Federation of California] said. Read More ›

3 Ways To Track Down Your Old Debts

by Gerri Detweiler, Credit.com

When you’re on a mission to clean up your credit, there’s one task that may prove more difficult than you’d think: figuring out who you owe. That’s especially true if some of your debts are old, and have been sold by your creditors to collection agencies. These debts may be bought and sold multiple times, and some even remain in limbo for months or years. Tracking down the owner of a debt so you can pay it sometimes proves challenging. Here are three ways to find your debts so you can resolve them, along with three crucial things you need to understand when you do. Read More ›

Data Broker Is Charged With Selling Consumers’ Financial Details To ‘Fraudsters’

by Natasha Singer, New York Times

This week, the Federal Trade Commission filed a lawsuit claiming that a data broker in Nevada sold intimate details about several hundred thousand people, including their Social Security numbers and bank account numbers, to marketers and other companies that had no legitimate need for that data. Read More ›

This Is How Your Gmail Account Got Hacked

by Jose Pagliery, CNN Money

It takes only 3 minutes to scan your email for valuable stuff. They’re looking for any email that shows your bank account information and images of your real life signature. They also search for login credentials for other accounts at Amazon or PayPal. They use the email search feature, looking for phrases like “wire transfer,” “bank” and “account statement. Safety tip: Perform this search yourself. Go ahead and erase any email with this sensitive data. Don’t leave this stuff lying around. Read More ›

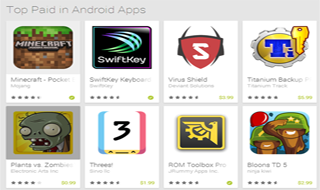

Top Android app a scam, pulled from Google Play

by Stephanie Mlot, PC Mag

According to Android Police, Virus Shield is a fake security app: Instead of scanning apps, settings, files, and media, like the service advertises, its shield icon simply changes from an “X” image to a check mark after a single tap. Read More ›

Five Signs of Financial Elder Abuse You Can Spot Now

by John Wasik, Forbes

Some of the most insidious swindles involve exploitation of older Americans. Fortunately, there are some clear warning signs of chicanery. Here’s what you need to look for. Read More ›

Don’t Fall for Valentine’s Day Scams

by Jason Alderman, Practical Money Skills

Whatever your love status, one thing everyone needs to guard against at this time of year is scams. Here are some of the more common Valentine’s Day scams to avoid. Read More ›