Category Archives: Latest In Consumer News

CFPB Lawsuit: Sprint Made Millions Off Consumers Acting As A “Breeding Ground” For Bill-Cramming

by Ashlee Kieler, Consumerist

The CFPB reports that most affected Sprint customers were initially targeted by the third-party products online. “Consumers clicked on ads that brought them to websites asking them to enter their cellphone numbers,” officials with the CFPB say in a news release. “Some merchants tricked consumers into providing their cellphone numbers to receive ‘free’ digital content and then charged for it. Many others simply placed fabricated charges on bills without delivering any goods or communicating with consumers.” Read More ›

CFPB: College Credit Card Agreements On Decline; Debit, Prepaid Card Agreements Increase

by Ashlee Kieler, Consumerist

Now, instead of signing onto agreements for the more regulated credit cards, [banking institutions and colleges] are focusing on debit and prepaid cards, which generally have fewer consumer protections. In fact, a report from the Government Accountability Office earlier this year found there were at least 852 schools that had agreements with companies to market debit or prepaid cards to students in 2013. Read More ›

Jury Sides With Apple In iPod Antitrust Case

by Julia Love, San Jose Mercury News

Plaintiffs’ lawyer Patrick Coughlin said his team wanted jurors to evaluate only the new security codes that limited downloads to the iTunes store, effectively blocking competing programs like RealNetworks’ Harmony. But instead, jurors considered whether those features, taken together with other new offerings in iTunes 7.0 such as games and movies, improved the user experience, making the plaintiffs’ case a tougher sell, Coughlin said. He vowed to appeal the case. Read More ›

When It’s Time To Flee, Uber Raises Its Rates

by C.W. Nevius, San Francisco Chronicle

Is this just a dumb public relations miscue, or is this just the new model for startup culture? … Rather than anticipate the problem — recognize that surge pricing in an emergency is not a good policy — companies like Uber would rather just put the pedal to the metal and deal with the speed bumps when they come up. Speed bumps like these: San Francisco District Attorney George Gascón sues Uber over what he says are inadequate driver background checks. Portland, Ore., declared Uber illegal, citing a lack of adequate insurance, among other things. Uber has been sued in Madrid and banned in New Delhi. Read More ›

CPUC Commissioner Tied To E-Mail Saying He’d Help PG&E

by Jaxon Van Derbeken, San Francisco Chronicle

Until now, [CPUC Commissioner Mike] Florio has escaped repercussions from the interactions, with much of the focus on outgoing commission President Michael Peevey, whose chief of staff had promised to help company executives who were trying to get a judge of their choice in a key gas rate case arising from the San Bruno explosion that killed eight people and injured nearly 60. … “This shows this is the tip of the iceberg,” said Britt Strottman, attorney for the city. “We now know there are more e-mails out there that PG&E should have disclosed in the first place.” Read More ›

The Big Business Of Selling Prescription-Drug Records

by Jordan Robertson and Shannon Pettypiece, Businessweek

Now that data mining has enabled pharmacy companies to adopt the practice, some critics say technological advances are undoing protections provided by the Health Insurance Portability and Accountability Act, the federal medical privacy law. … Matchbacks have solved one of Big Pharma’s biggest marketing headaches: the layers of physicians, pharmacists, and insurers that stood between drugmakers and patients in the past. “This is the holy grail for every pharmaceutical company, to know that there’s a way to look back to actual script information,” says targeted-ad pioneer Helene Monat. Read More ›

Why You Should Think Twice About ‘Buy Now, Pay Interest Later’ Deals

by Herb Weisbaum, Today

About half the retailers that offer some sort of financing program offer deferred interest plans, according to a recent survey by CardHub.com, a credit card comparison website. The report, Retailers with the Sneakiest Financing Offers, concludes that this is a “decidedly misleading and potentially harmful financing option.” Card Hub CEO and founder Odysseas Papadimitriou says these deferred interest offers are completely different from credit cards that offer zero percent interest on new purchases for a certain amount of time. Miss a payment on the credit card and you only pay interest on the unpaid balance – it’s not retroactive. Read More ›

CFPB Takes Action Against Two Alleged Student Debt Relief Scams

by Ashlee Kieler, Consumerist

The CFPB alleges that College Education Services promised consumers quick relief from default and garnishments. However, the principal debt relief approach the company used – loan consolidation − did not and could not ensure those benefits in all cases, and not in the quick timeframe the company promised. … In a separate but related filing today, the CFPB filed a lawsuit against Student Loan Processing.US to stop the company’s illegal conduct and provide restitution to consumers harmed by the fraudulent actions. Read More ›

New Rule Aims To Curb Inaccurately Reported Medical Debt

by Ashlee Kieler, Consumerist

[The most common complaints] involve claims from consumers that information furnished by these collectors to credit reporting agencies are inaccurate due to errors in billing or slow-moving insurance claims. In fact, the CFPB reports that consumers identifying as having medical debt are more than twice as likely to claim that the debt was paid than consumers with other types of debt. Today the CFPB took steps to ensure that these issues have less impact on consumers and that credit reporting companies are doing their part to ensure consumers’ records are as accurate as possible. Read More ›

S.F., L.A. Sue Uber ‘To Protect Consumers’; Lyft Settles Charges

by Carolyn Said, San Francisco Chronicle

Privately held Uber last week raised $1.2 billion in funding, giving it a valuation of $40 billion — more than CBS, American Airlines or Kraft Foods. But the San Francisco company continues to anger regulators. In the past week, Uber was banned in India, Spain and Thailand and threatened with a ban in Portland, Ore. … Gascón laid out several allegations against Uber. Uber falsely claims that its driver background checks are superior to those for taxi driversUber charges passengers a $1 “safe rides fee” … and falsely claims that money goes toward “industry-leading” background checks.

Read More ›

Online Deals For Holiday Shopping: Buyer Beware

by Farhad Manjoo, The New York Times

During the holidays, Ms. Cheng turns her entire staff of about 20 writers and editors toward investigating advertised discounts on technology and home goods. “I kind of expected that we would be able to say that 85 percent or 90 percent were bad, but it turns out that almost literally every single one is bad,” Ms. Cheng said. So far this year, The Wirecutter and The Sweethome have researched 54,000 holiday deals. They’ve found only a bit more than 300 of them — less than 1 percent — are worth your time. Read More ›

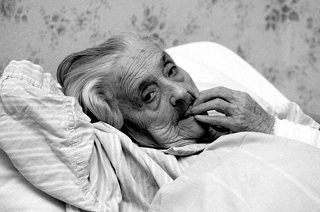

Nursing Homes Rarely Penalized For Oversedating Patients

by Ina Jaffe, Robert Benincasa, National Public Radio

NPR’s analysis [of federal data] found that harsh penalties are almost never used when nursing home residents get unnecessary drugs of any kind. … The agency’s new goal for nursing homes is an additional 15 percent reduction in antipsychotic drug use by the end of 2016. But even if that goal is met, it will mean that after a five-year effort, almost a quarter of a million nursing home residents will still be getting largely unnecessary and potentially lethal antipsychotic drugs. Read More ›

Comcast Sued For Turning Home Wi-Fi Routers Into Public Hotspots

by Benny Evangelista, San Francisco Chronicle

The suit claims the company turns the service on without permission and places “the costs of its national Wi-Fi network onto its customers.” … Tests showed that under heavy use, the secondary channel adds 30 to 40 percent more costs to a customer’s electricity bill than the modem itself, the suit said. The suit also said “the data and information on a Comcast customer’s network is at greater risk” because the hotspot network “allows strangers to connect to the Internet through the same wireless router used by Comcast customers.” Read More ›