With Billions In The Bank, Blue Shield Of California Loses Its State Tax-Exempt Status

by Chad Terhune, Los Angeles Times

Anthony Wright, executive director of Health Access, said the tax board’s decision could have a significant effect on the debate over Blue Shield’s future and on health policy statewide. “It’s important to have this debate over Blue Shield’s public-service mission and how they are fulfilling it,” Wright said. “What would a white-hat insurer look like?” … Some consumer groups have also questioned whether certain Blue Shield spending is out of line with its nonprofit mission. Read More ›

San Bruno: PG&E Should Pay $1.6 Billion Penalty As Punishment For Fatal Blast Says Top Regulator

by George Avalos, San Jose Mercury News

A consumer group, The Utility Reform Network, praised the proposal from [California Public Utilities Commission President Michael] Picker, but warned that vigilance is still needed to ensure the PUC doesn’t accommodate PG&E unduly in other decisions. Among those pending matters: a plan to finance PG&E improvements to its natural gas transmission and storage system. That proposal could produce an increase in gas bills of 11.8 percent, or $5.23 a month for the average residential customer. Read More ›

CFC Sponsors Bill To Protect Seniors From Unethical Long-Term Care Referral Agencies

SACRAMENTO – The Consumer Federation of California (CFC) is sponsoring Senate Bill 648 (Mendoza, D-Artesia) to increase disclosure requirements and strengthen oversight of private placement agencies that refer seniors to residential care facilities for the elderly (RCFEs). Read More ›

Lawmaker Seeks To Squelch Flame Retardants

by Samantha Weigel, San Mateo Daily Journal

Leno said SB 763 is a continuation of his successful legislation last year that requires upholstered furniture such as beds and couches be labeled as to whether they contain flame retardant chemicals. Ultimately, the hope is informed consumers through market demand will phase out the use of flame retardants, Leno said. “Our new fire safety standard, equally fire safe … allows for compliance with or without the use of these toxic flame retardants,” Leno said. Read More ›

Regulators’ E-Mails With PG&E Blasted As Culture Of ‘Lawlessness’

by Jaxon Van Derbeken, San Francisco Chronicle

Stephen Weissman, a UC Berkeley energy law professor who previously worked as a lawyer at the [California Public Utilities Commission], said the current standards reflect a “cultural divide” with similar agencies in other states that ban such lobbying altogether. “California does not even discourage” the contacts, Weissman said. “To the contrary, it welcomes them.” Worse, he said, is that there is no penalty for utilities commissioners who violate the rules. There is not even a requirement that commissioners report such lobbying. “We feel this lack of direct accountability,” Weissman said, is a “major contributing factor to the apparent repeated violations.” Read More ›

SB 763: CFC, Firefighters, Environmentalists Back Disclosure Of Chemical Hazards In Children’s Products

The Consumer Federation of California (CFC) has joined with professional firefighters and environmental advocates to co-sponsor legislation letting parents know whether products they buy for their children contain ineffective and hazardous flame retardants. … These chemicals have been linked to reproductive harm, cancer and other human health hazards. Fire safety experts consider them to be ineffective in preventing household fires. Read More ›

CFC, Firefighters, Environmentalists Back Disclosure of Chemical Hazards in Children’s Products

SACRAMENTO – The Consumer Federation of California (CFC) has joined with professional firefighters and environmental advocates to co-sponsor legislation letting parents know whether products they buy for their children contain ineffective and hazardous flame retardants. Read More ›

Binding Arbitration Rules Get Consumer Protection Bureau Scrutiny

by Ann Carrns, New York Times

Customers who have disputes with banks or credit card companies often can be forced to go to arbitration before a private lawyer to try to resolve the problem, rather than before a judge in court. That’s because many financial accounts come with built-in contracts containing “pre-dispute” arbitration clauses — so-called because consumers agree to them when they sign up for the account, before they actually have a disagreement. Read More ›

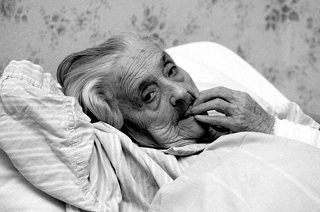

Castro Valley: Two Charged With Felony Elder Abuse In Abandoned Care Home Case

by Katie Nelson and Karina Ioffee, Contra Costa Times

The charges come after the shocking Valley Springs case and other incidents around the state shined a light on the state Department of Social Services’ oversight of such facilities. … The Department of Social Services, which oversees the licensing of senior care facilities like Valley Springs Manor, admitted that they had a “complete breakdown” in communication and that the closure forced them to re-evaluate their closure process as well as update training for state employees who monitor facilities. Read More ›

Lawsuit Contests CPUC Lawyer Hiring

by Jeff McDonald, UT-San Diego

[Plaintiffs attorney:] “They are misusing public funds by hiring lawyers — very expensive lawyers — to hide public records that relate to the misuse of ratepayer funds.” … According to [CPUC President Michael] Picker, the commission is facing at least three separate criminal investigations — two by the California Attorney General’s office and one by the U.S. Department of Justice. … Investigators are looking into alleged favoritism by [ex-CPUC President Michael] Peevey and others after a deadly 2010 pipeline explosion in San Bruno and the 2012 failure of the San Onofre nuclear power plant. Read More ›

Credit-Reporting Companies Agree To Major Changes To Reduce Errors

by Jim Puzzanghera, Los Angeles Times

The nation’s three largest credit-reporting companies have agreed to make it easier for consumers to correct mistakes, as well as to wait longer to list unpaid medical bills to allow more time for insurance payments, according to a government settlement announced Monday. The changes are designed to … Read More ›

Government DNA Collection Under Microscope In California

by Jeremy B. White, The Sacramento Bee

Assemblymember Mike Gatto has a pair of bills that would allow parents to have their babies’ samples destroyed, and dictate when police officers can glean DNA. With the support of district attorneys, Assemblyman Jim Cooper has a bill allowing DNA collection from people convicted of certain misdemeanors. Read More ›

Lumber Liquidators Sued Over Formaldehyde Allegations

by Chris Morran, Consumerist

The suit alleges … the company “breached their warranties by manufacturing, selling and/or distributing flooring products with levels of formaldehyde that exceed the CARB standards, or by making affirmative representations regarding CARB compliance without knowledge of its truth.” Lumber Liquidators is also accused of the California Business and Professions Code’s prohibitions against “unlawful, unfair, or fraudulent business act or practice,” false advertising. Additionally, the plaintiffs allege that misrepresenting the [California Air Resources Board] certification of the wood violates the California Consumer Legal Remedies Act. Read More ›