Why You Shouldn’t Get a Reverse Mortgage Just Because Fred Thompson Tells You to

by Ashlee Kieler, Consumerist

Reverse mortgages have been found to leave families with debts they can never repay, four-in-five payday loans are made to consumers already caught in the debt trap, and on average 54% of students who attend a for-profit college leave without a degree — with one-in-five of those students defaulting on their loans. … Consumers Union, along with California Advocates for Nursing Home Reform provided comments to the Consumer Financial Protection Bureau regarding consumers’ use of reverse mortgages. Read More ›

CFC Addresses Benefits and Risks of Driverless Cars

Noting that the technology could reduce accidents if it’s widely adopted, CFC Executive Director Richard Holober stressed the need to ensure that any savings get passed along to consumers under Proposition 103. He also cited concerns about who would have access to data from the vehicles, and of possible meddling by hackers. Read More ›

Americans Say They Want Privacy, but Act as if They Don’t

by Claire Cain Miller, The New York Times

Pew offered some evidence that people are inured to the trade-offs of using digital services: Ninety-one percent agree or strongly agree that consumers have lost control over how their personal information is collected or used by companies. They are unsure what to do about it, though. Nearly two-thirds say they would like to do more to protect the privacy of their personal information online. About the same number think the government should do more to protect them. Read More ›

California’s Strawberry Industry Is Hooked on Dangerous Pesticides

by Bernice Yeung, Kendall Taggart and Andrew Donohue, Center for Investigative Reporting

Growers rely on heavy amounts of some of the most dangerous pesticides – a class called fumigants – to deliver the fruit year-round at an affordable price for consumers. Because strawberries like to grow where people like to live, in the perpetual spring of coastal California, growers often use the pesticides near schools, homes and businesses. … Nearly a decade after the pesticide was supposed to be banned, the state’s strawberry growers have staved off the deadline by warning of financial ruin. Today, they use about 90 percent of all the methyl bromide in the developed world. Read More ›

GM Ordered Switches Nearly 2 Months Before Recall

by Tom Krisher, The Associated Press

The switches can slip out of the run position, causing engines in cars such as the Chevrolet Cobalt to stall. If that happens, the power steering, brakes and air bags are disabled, and people can lose control of their cars. GM eventually recalled 2.6 million small cars for the problem, which has caused at least 32 deaths. The emails in the chain, which run from December into February, call the matter “urgent” and eventually use the words “safety issue.” Read More ›

Apple Mobile Devices Vulnerable To App Attack, FireEye Says

by Jeremy C. Owens, San Jose Mercury News

Apple mobile devices can leak users’ information through an attack using apps distributed outside the company’s App Store, a prominent Silicon Valley security company disclosed Tuesday. … Hackers could offer a mobile app through the Web that would mimic a legitimately downloaded application on a user’s device, siphoning important information such as login info or emails. An example provided showed that a third-party app called “New Flappy Bird” could replace the Gmail app and access cached emails, using the same “bundle identifier” that Apple uses for the Gmail app. Read More ›

Do You Trust Telecom Industry? That’s Why We Need Open Internet

by David Lazarus, Los Angeles Times

Not surprisingly, the telecom industry’s knee-jerk, sky-is-falling response to the president’s words blew the entire matter out of proportion. Obama isn’t calling for the digital masses to rise up and seize the means of network production. All he’s saying is that the Federal Communications Commission should have the authority to make sure that telecom companies keep the Internet open and accessible to all and to make sure that no business behemoth — a Netflix, say, or Amazon.com — can shell out big bucks for fast-lane preferential treatment. Read More ›

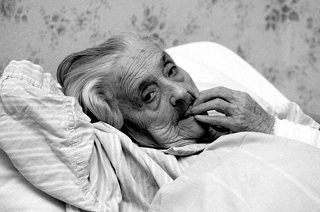

Unmasked: How California’s Largest Nursing Home Chains Perform

by Marjie Lundstrom and Phillip Reese, The Sacramento Bee

Knowing who owns what can be critical for fragile patients seeking long-term care, according to a Sacramento Bee investigation, which analyzed thousands of federal and state records detailing the ownership of the state’s 1,260 nursing homes. In addition to identifying owners with at least a 5 percent stake in any California-based facility, The Bee also examined government and industry data to determine how the largest owners and their facilities performed on 46 measures, including quality-of-care indicators, staffing, complaints and deficiencies found during inspections. Read More ›

This Is How Your Gmail Account Got Hacked

by Jose Pagliery, CNN Money

It takes only 3 minutes to scan your email for valuable stuff. They’re looking for any email that shows your bank account information and images of your real life signature. They also search for login credentials for other accounts at Amazon or PayPal. They use the email search feature, looking for phrases like “wire transfer,” “bank” and “account statement. Safety tip: Perform this search yourself. Go ahead and erase any email with this sensitive data. Don’t leave this stuff lying around. Read More ›

New Consumer Laws Passed

In the 2013-2014 legislative session, Consumer Federation of California played a key role in enacting new laws protecting our online privacy, restricting unfair lending practices, enabling consumers to buy toxic-free household products, and cracking down on elder abuse. CFC also helped to defeat attacks on our medical … Read More ›

CFPB Finds Older Consumers Face Illegal, Harassing Tactics from Debt Collectors

by Ashlee Kieler, Consumerist

A new report from the Consumer Financial Protection Bureau shines light on the issues older consumers face when it comes to their financial well-being. According to the report, which looked at older consumers’ complaints filed with the CFPB between July 2013 to September 2014, the number one issue Americans 62 years of age and older faced involved their experiences with debt collectors. The CFPB issued a consumer advisory including tips for older Americans faced with debt collection. Read More ›

Why Some People Pay More Than Others When Shopping Online

by Gerry Smith, The Huffington Post

The study is the latest attempt to shed light on the opaque methods that many e-commerce sites use to show consumers different online deals. The strategy is based on data collected about shoppers and is often a way to boost sales. In 2012, the Wall Street Journal found that Staples was displaying different prices to people based on their locations and Orbitz had shown different hotel offers to Mac and PC visitors after learning that Mac users spent more on hotels. Orbitz told the Northeastern researchers it discontinued the practice, which it called an “experiment.” Read More ›

Fatal Accident Tests Lyft’s $1 Million Insurance Policy

by Carolyn Said, San Francisco Chronicle

While a driver is providing a ride or on the way to pick up a passenger, Lyft offers $1 million in liability insurance, and $1 million in uninsured/underinsured motorist coverage. … California legislators recently passed a bill to require coverage when a driver is logged into the companies’ apps but hasn’t yet been matched with a passenger. The mandated coverage, set to take effect July 1, would top off at $200,000. Read More ›