Corinthian Colleges to sell off 85 campuses; close 12 others

by Chris Morran, Consumerist

For-profit education company Corinthian Colleges – operators of Everest University, WyoTech, and Heald College – which had been receiving around $1.4 billion a year in funding via federal student loans, is currently being sued or under investigation by numerous state and federal authorities for its recruitment and marketing practices. The U.S. Dept. of Education put a hold on its access to loan funds, effectively ringing the death knell for the company. Read More ›

SB 52 Strengthens Campaign Contribution And Advertising Transparency (2-year bill)

The provisions in SB 52 will help ensure that the public is more aware of what and who is influencing California’s elections. Read More ›

Uber, Lyft setback: Insurance chief backs proposal to hike coverage requirements

by Patrick Hoge, San Francisco Business Times

An insurance gap was highlighted last New Year’s Eve when a driver seeking passengers in San Francisco with the UberXd smartphone application open struck and killed a little girl. Uber argues it isn’t liable because the driver didn’t have a ride order at the time. The girl’s parents sued; their attorney said the driver’s insurance only allowed for maximum payouts of $15,000 per person and a maximum of $30,000, the California minimum. Read More ›

GM has officially recalled more vehicles in 2014 than it has sold in the last 7 years

by Ashlee Kieler, Consumerist

On Monday, the company announced the recall of 7.6 million vehicles in the United States – most of them for the same inadvertent ignition key rotation that has been linked to at least three fatalities. So far in 2014, GM has recalled nearly 25 million vehicles in the United States through more than 50 recall campaigns. A quick look at GM’s sales records for the past ten years shows that the company has now officially recalled in the first six months of 2014 more cars that it has sold from 2007 to 2013. Read More ›

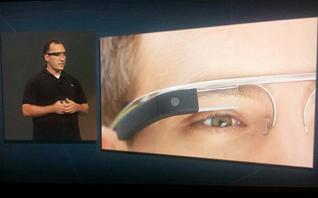

Google Glass is the perfect tool for stealing your phone’s passcode

by Polly Mosendz, The Atlantic Wire

Most people using smart devices have a simple password set up — four digits that protect your phone or tablet from prying eyes and theft. Usually, these passwords are quite easy to protect when in public; just type it in quickly and no one will notice, especially outdoors sun glare makes it hard to read your screen. However, if you find yourself typing in your password in the presence of a Google Glass wearer, beware. Read More ›

Burned: How the chemical industry is endangering lives with toxic flame retardants

by Gary Cohn, Capital and Main

SB 1019 has national implications for consumers, manufacturers and retailers, and is fiercely opposed by the American Home Furnishings Alliance, the North American Home Furnishings Association and the Polyurethane Foam Association. Beyond these and other industry groups, it is being fought by the National Federation of Independent Businesses and the California Chamber of Commerce. Read More ›

California should warn consumers about ‘toxic’ flame retardants

by The Editorial Board, The Sacramento Bee

Numerous studies buttress the warning in Leno’s legislation. A study last year by the MIND Institute at UC Davis found one component of flame retardants accumulates in human blood, fat and breast milk. The institute summarized the study by saying the “chemical, quite literally, reduces brain power.” Earlier this month, Kaiser Permanente provided a boost to Leno’s effort by becoming the first health care provider in the nation to announce it would stop purchasing furniture treated with flame retardants. Read More ›

Bill would restore online privacy

by Richard Holober, Los Angeles Daily News guest commentary

CFC Executive Director Richard Holober: “Next week California lawmakers decide whether to protect your privacy when you purchase downloads. Senate Bill 383 would restore privacy rules that a sharply divided state Supreme Court eliminated in a 2013 case involving Apple’s iTunes. Consumer groups support the bill. Tech companies are working furiously to defeat it.” Read More ›

SB 686: Drive to stop sale of recalled cars runs out of gas

A scandalous and possibly unprecedented year for automobile recalls wasn’t enough to persuade the Assembly Business Professions and Consumer Protection Committee to maintain SB 686’s safety drive; the measure went down to defeat June 17. “This Legislature just wasn’t up to standing up to the car dealers,” said Rosemary Shahan, president of Consumers for Auto Reliability and Safety, the organization that sponsored the bill. She vowed to continue to press the issue.

Read More ›

Carriers’ tight grip on cellphone unlocking seems to have resulted in a cyberattack

by Bryan Fung, The Washington Post (blog)

AT&T says the hackers’ intent wasn’t to steal credit card numbers or commit other financial fraud. Instead, all they wanted was to pretend to be an AT&T customer so they could do something far more benign: unlock old, used handsets. The process frees up a device so that it can be taken from one carrier’s network to another. AT&T and other carriers currently let you unlock your phone, but with heavy restrictions Read More ›

Comcast Wi-Fi hotspots to count on routers in homes

by Benny Evangelista and Dwight Silverman, San Francisco Chronicle

Comcast plans to turn thousands of wireless Internet routers in private homes in the Bay Area into publicly available Wi-Fi hotspots. The service is part of the cable giant’s ambitious plan to offer customers and noncustomers access to about 8 million hotspots in 19 of the largest U.S. cities. Customers might feel uncomfortable about the company converting their wireless gateway routers into a public network – whether it’s because of privacy, security, bandwidth or energy concerns. Read More ›

Supreme Court rules against false advertising on food, drink labels

by David G. Savage, Los Angeles Times

The implications could go considerably beyond the small but trendy world of pomegranate juice, opening a wide range of product labels to challenge. Until Thursday, many judges and food-industry lawyers maintained that sellers of beverages and food products could not be sued for false advertising so long as the product’s label accurately disclosed the ingredients in small print, as required by the Food and Drug Administration. Read More ›

Facebook is now selling your Web-browsing data to advertisers

by Chris Moran, Consumerist

Facebook has long been following you around the Web, quietly snickering at you for the music you buy and silently cocking an eyebrow for thinking you can still fit into the same size jeans you wore in college. But until now, it had tracked users under the pretense of security. This morning’s announcement shows the site’s true intentions. Read More ›