Facebook will offer anonymous log-ins for apps

by Benny Evangelista, San Francisco Chronicle

Facebook is testing a way for users to sign in to a mobile app without divulging their identity, a feature that could appeal to members worried about privacy. The Anonymous Login feature signaled a sea change for a company that built a global network of 1.28 billion monthly active members by requiring them to use real names and prodding them to share as much of their lives as possible. Read More ›

We Saved Consumers $125 Million On Insurance So Far In 2014

by Richard Holober, Executive Director, Consumer Federation of California

10/1/2014 Update: 2014 consumer savings rose to $148.3 million by year’s end. To recap: 1 million AIG policyholders saved $7.7 million on homeowners insurance. Infinity Insurance policyholders saved $15.5 million on auto insurance. 1.2 million Farmers policyholders saved $34 million on homeowners insurance (details below). 1.6 million … Read More ›

New FCC rules let ISPs create Internet fast lanes, for a price

by James K. Willcox, Consumer Reports

There’s been a fairly loud public outcry at the news that the Federal Communication Commission is proposing new “net neutrality” rules. The big concern: Under the proposal, first reported by the Wall Street Journal, ISPs will be allowed to give preferential treatment to traffic from companies that are willing and able to pay a premium for that top-tier service. Read More ›

Verizon Wireless sells out customers with creepy new tactic

by David Lazarus, Los Angeles Times

Verizon is enrolling customers in the “enhanced” program by automatically downloading software into their computers, which customers may not even know is happening. If Verizon Wireless customers want to keep their computers off-limits to the company’s marketing affiliates, they’d have to go to the trouble of opting out. This is one of the more outrageous examples of how businesses loudly proclaim their commitment to safeguarding consumers’ privacy while quietly selling us out to the highest bidder. Read More ›

Lawmakers reject bill requiring cell phone kill-switch

by Melody Gutierrez, San Francisco Chronicle

California state Sen. Mark Leno said a powerful and deep-pocked wireless communications industry killed his bill requiring antitheft technology on smartphones. With support from law enforcement, the bill requiring “kill switches” on mobile devices fell two short after nearly all Republicans and several Democrats voted against it, including senators Jim Beall, Ricardo Lara, and Norma Torres. Read More ›

Warren in new book accuses Kashkari of lying as TARP chief

by Seema Mehta, Los Angeles Times

In her new book, “A Fighting Chance,” Massachusetts Sen. Elizabeth Warren accuses California gubernatorial candidate Neel Kashkari of lying to her when he led the taxpayer-funded federal bank bailout. Read More ›

California car data bill stalls in first committee

by Jeremy B. White, Sacramento Bee

Only one lawmaker voted against Senate Bill 994 on Tuesday, but seven abstained from voting. The final vote count, 3-1, was three votes short of what the legislation needed to advance beyond the Senate Transportation and Housing Committee. Read More ›

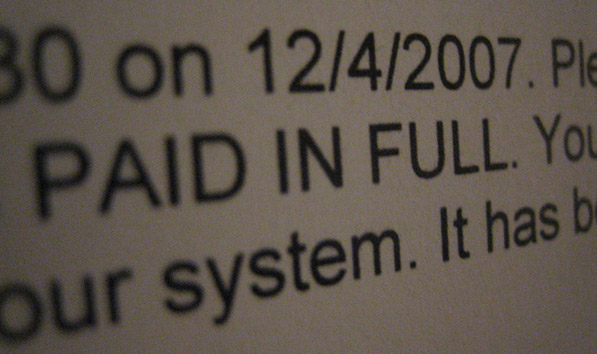

Nasty surprise for some student loan borrowers

by Herb Weisbaum, CNBC

Students who take out private loans to pay for college could face a nasty surprise if their co-signer dies or files for bankruptcy: The lender may suddenly demand the loan be paid in full—or even worse, put that loan in default—even though all payments are being made on time. The Consumer Financial Protection Bureau issued a consumer advisory on Tuesday, warning borrowers that these “auto-default” clauses may be in their loan agreements and serious financial consequences could result. Read More ›

Walgreens store redesign raises privacy concerns

by Chris Richard, KQED

Privacy activists are voicing concern that Walgreens pharmacies may endanger the confidentiality of customer records with a new business model that places pharmacists at a desk on the store floor. The “Well Experience” model makes it much easier for customers to view pharmacists’ computer screens and documents on their desks. Read More ›

General Mills thinks you’re stupid, but decides to not take customers’ legal rights away

by Chris Morran, Consumerist

It seemed ridiculous to think that the makers of cereal would resort to a forced arbitration clause, or how they would even be able to do it. But last week, General Mills tried, adding language to its website that stripped certain customers of their access to legal redress against the company. Realizing that maybe this might tick off an awful lot of people, the company has backed off this policy change. Read More ›

As data about drivers proliferates, auto insurers look to adjust rates

by Alina Tugend, New York Times

It’s no surprise that car accidents, speeding tickets and where you live all affect how much you pay for automobile insurance. But consumer groups say that other, apparently unrelated, factors are unfairly being used to set rates. Two organizations have released separate reports contending that the factors insurance companies are using to determine rates — like educational level and occupation — are detrimental to consumers, especially to low-income customers. Read More ›

When ‘Liking’ a Brand Online Voids the Right to Sue

by Stephanie Strom, New York Times

The change in legal terms, which occurred shortly after a judge refused to dismiss a case brought against the company by consumers in California, made General Mills one of the first, if not the first, major food companies to seek to impose what legal experts call “forced arbitration” on consumers. Read More ›

Smartphone ‘kill switches’ on the way

by Carolyn Said, San Francisco Chronicle

Smartphone thefts have grown increasingly violent as the devices have risen in value, commanding several hundred dollars each on the black market. The Federal Communications Commission said mobile-device theft is the No. 1 property crime in America. The industry has struggled with a response. Just this month, industry representatives testified they couldn’t offer the type of solution that they now are proposing. Read More ›