FTC Approves Oversight Program For Compliance With Kids’ Online Privacy Rules

by Kate Cox, Consumerist

No seal of approval by itself can make the internet safe for anyone, let alone for kids, but parents can at least rest assured that if they see this one on any site their children are using, the FTC thinks it’s legit. Read More ›

Don’t Fall for Valentine’s Day Scams

by Jason Alderman, Practical Money Skills

Whatever your love status, one thing everyone needs to guard against at this time of year is scams. Here are some of the more common Valentine’s Day scams to avoid. Read More ›

Friendly sales pitch can’t hide payday loans’ unfriendly rates

by David Lazarus, Los Angeles Times

Welcome to the new-and-not-so-improved world of payday lending, which has adopted more sophisticated sales pitches and branding to lure unwary consumers into loans that can trap them in endless cycles of debt. Read More ›

New bill demands that smartphones have “kill switch” in case of theft

by Joe Mullin, Ars Technica

California state legislator Mark Leno has introduced SB 962, a bill that would require smartphones sold in the state to include a “kill switch” that would “render inoperable” the phone if it’s not in the possession of the rightful owner. Read More ›

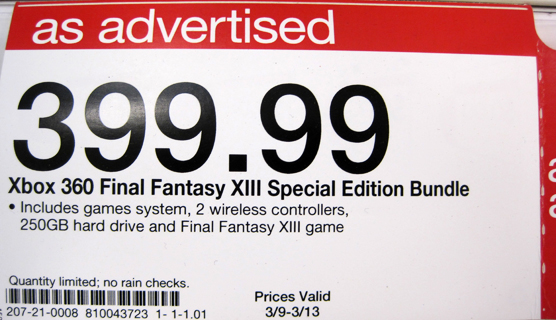

Cracking Price Tag Codes

by Jim Donovan, CBS 3 Philadelphia

When is a sale price really a steal? Or a clearance tag so low there’s no place else to go? Read More ›

Corinthian Colleges discloses Fed’s probe of job placement numbers

by Ricardo Lopez, Los Angeles Times

Federal regulators are investigating for-profit college chain Corinthian Colleges Inc. for falsifying job-placement rates, adding to at least a dozen other state and federal investigations into the company’s business practices, Corinthian disclosed in an earnings statement Wednesday. Read More ›

True cost of transporting a $25 checked bag? About $2

by Ellen Creager, Detroit Free Press

When airlines began charging for checked bags in 2008, they blamed the high cost of jet fuel for the move. But how much does it actually cost an airline in jet fuel to transport your suitcase? About $2 and maybe less. That means the airline is charging you more than 12 times its cost when it makes you pay a $25 baggage fee. Read More ›

Daily Deal Sites Now Full of Deceptive Discounts

by Patricia Lopez, ABC 13 Houston

Flash sale and discount websites are hot shopping destinations for consumers who want to find bargains on luxury and designer goods. But some of these sites are now selling their own trademarked brands and advertising an original and discounted price. In many cases the merchandise is not available anywhere else. Read More ›

Can You Trust the Hotel Review Sites?

by Robert McGarvey, MainStreet

When real people, who have spent their own money, offer commentary on a hotel, you have to want to listen. You need, however, to know about the many fake reviews – self-congratulatory reviews posted by a hotel on itself and some even post smears of competitors. How common is this? Read More ›

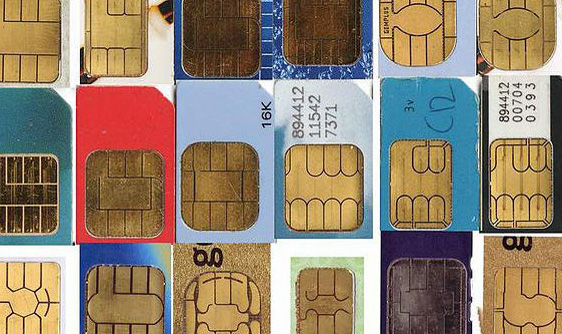

Swiping your plastic: Cards with microchips could become more common

by Claudia Buck, Sacramento Bee

The buzz is about switching U.S. credit and debit cards to ones embedded with a tiny microchip containing a customer’s data. Widely used in Europe, Asia and Latin America, these so-called “smart cards” have sharply curbed financial losses due to counterfeit, lost or stolen cards. Until now, they’ve been almost unheard of in the United States, but that’s changing.

Read More ›

After the Breach: Protecting Your Identity

by AnnaMaria Andriotis, Wall Street Journal

Target is offering one year of free credit monitoring and identity-theft insurance from Experian to in-store shoppers. Neiman Marcus is giving the same services to all its shoppers, and Easton-Bell is using another provider for shoppers whose information was stolen. But affected consumers still might get tripped up. Read More ›

Are there too many products on store shelves?

by WCPO Staff, WCPO Cincinatti

Back in 1975, your average supermarket carried around 9,000 products. Fast-forward almost 30 years, and that number has swelled to nearly 47,000. But could so much selection be leading to supermarket overload? Read More ›

Inside a for-profit college nightmare

Jaqueta Cherry did not have a glittering GPA or a résumé loaded with internships and varsity letters. She dropped out of high school at age 17. But last fall, right after she received a general equivalency diploma, for-profit colleges and universities besieged her with offers of admission. … Read More ›