Email Scams to Avoid This Tax Season

by Daryl Paranada, Huffington Post

Not many people like tax season. It can be stressful, complicated, and financially draining. But tax time is enjoyable for some folks — scam artists. Read More ›

AT&T Mobile Insurance customer contract terms ring hollow

by David Lazarus, Los Angeles Times

Not only did AT&T and its partner, an insurance provider called Asurion, bury the most weaselly of provisions in their contract, they did so using language not even a master cryptographer could have deciphered. Read More ›

How a Hacker Intercepted FBI and Secret Service Calls With Google Maps

by Nitisha Tiku, Valleywag

The recorded callers thought they were speaking directly to the government agencies because they looked up the telephone number on Google Maps. What they didn’t know was that they had called fake listings for the San Francisco FBI office and Secret Service in Washington, D.C., displaying numbers that actually went to a private phone account. Read More ›

Assisted Living Giant Is Focus of Federal Probe

by A.C. Thompson, ProPublica

Investigators for the last year have been examining the operations of Emeritus Senior Living, the nation’s largest assisted living company. Read More ›

Report: Telemarketers Pocket Nearly 2/3 Of Charity Donations

by Chris Morran, Consumerist

While the person who calls you to ask for a charitable donation is probably representing a non-profit organization, that telemarketer may be employed by a for-profit fundraising company hired by the charity. But just how much of what you’re giving ends up going to the charity, and how much goes to line the telemarketer’s pockets? Read More ›

Why You Should Opt Out Of Forced Arbitration, In 3 Sentences

by Chris Morran, Consumerist

While more and more companies are adding “forced arbitration” clauses to their terms of service, only a handful of these businesses are offering customers the choice to opt out of this part of the contract. Here are the reasons why you should take advantage of that option … Read More ›

Working to Block Those Advertising Annoyances

by Alina Tugend, New York Times

Free ways to stop unwanted ads, phone calls and mail. Read More ›

Consumer Privacy Rights Need Urgent Protection in Washington, Activists Say

by Tom Hamburger, Washington Post

Citing revelations of government spying and massive theft of credit card information, civil liberties and consumer activist organizations are pressing the White House this week for action on a long-promised consumer privacy bill of rights. Read More ›

Fremont legislator seeks to bolster rights of care home residents

by Katie Nelson, Contra Costa Times

The bill would guarantee residents the right to be free from physical and chemical restraints and the possible inappropriate use of psychoactive drugs. The bill would also prohibit a licensee or employee of a facility from serving as an agent for a resident under a power of attorney. Read More ›

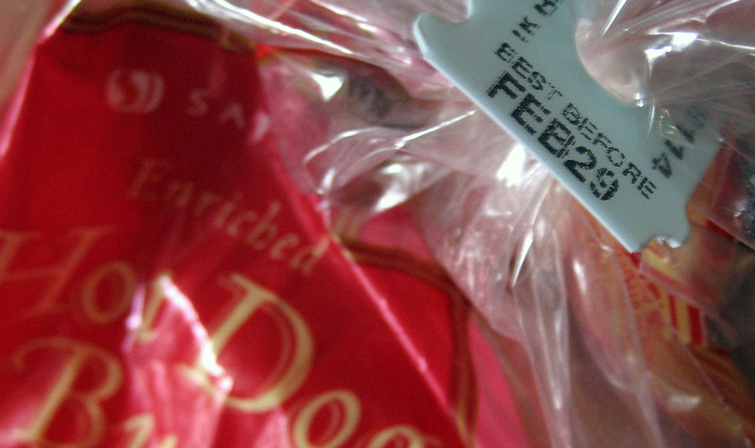

Market Gets Heat for Old “Sell By” Dates

by Hetty Chang, Keith Esparros, Phil Dreschler, NBC Los Angeles

Consumer advocacy groups have joined the United Food and Commercial Workers to release findings of an investigation, which alleges a popular supermarket chain sold expired products — including baby food, meat and diary products. At a news conference Tuesday, groups including the East LA Community Corporation and … Read More ›

Better credit cards, encryption considered to protect consumer data

by Jeremy B. White, Sacramento Bee

Lawmakers pushed on Tuesday for ways to prevent the kind of consumer data breaches that claimed voluminous amounts of information during the recent holiday season. Read More ›

Capital One says it can show up at cardholders’ homes, workplaces

by David Lazarus, Los Angeles Times

The company recently sent a contract update to cardholders that makes clear it can drop by any time it pleases. The update specifies that “we may contact you in any manner we choose” and that such contacts can include calls, emails, texts, faxes or a “personal visit.” Read More ›

Increasing food prices spark trend of package downsizing

by Jane Dornbusch, Boston Globe

The list of companies that choose to accommodate by shrinking package sizes is lengthy and only getting more so. Consumers might be willing to swallow, albeit reluctantly, either higher prices or smaller packages. What many find objectionable is the seemingly deceptive, or at least sneaky, way that manufacturers go about downsizing. Read More ›