Tag Archives: Insurance

California Tax Officials Blast Blue Shield In Audit

by Chad Terhune, Los Angeles Times

Blue Shield’s operations are indistinguishable from those of its for-profit healthcare competitors, the auditors found, and it should be stripped of the tax break it has enjoyed since its founding in 1939. The insurance giant does not advance social welfare, the key test for preserving its tax exemption, according to the records. … Since the revocation became public, Blue Shield has come under increasing scrutiny from regulators, lawmakers and consumer groups over its massive financial reserves and its proposed purchase of a Medicaid insurer for $1.2 billion. Read More ›

Ridesharing Drivers Often Stuck In Insurance Limbo

by Alice Holbrook, NerdWallet

Uber executives’ access to customer ride logs came under scrutiny last year, when a company manager referenced a reporter’s log during an interview. Some users were also disturbed by Uber’s use of ride logs to compile a study on customer hookups in 2012. Critics complain that the bill would make essential functions of TNCs, like using GPS to locate passengers, illegal. But [Richard Holober, executive director of the Consumer Federation of California] likens the regulations to medical privacy laws. “Even in a hospital, not just everyone is allowed to look at your medical records.” Read More ›

Why Did It Take 7 Months To Learn Blue Shield Lost Tax-Exempt Status?

by Chad Terhune, Los Angeles Times

California Insurance Commissioner Dave Jones on Wednesday applauded the [California Franchise Tax Board’s] move as further proof that “Blue Shield charges excessive rates and acts like a for-profit insurer.” Now consumer groups are asking for legislative hearings into the tax board’s handling of the Blue Shield matter. … State Sen. Ed Hernandez (D-West Covina), Senate Health Committee chairman, said he too wanted more answers from the franchise tax board and welcomes a debate over whether Blue Shield is meeting its obligations to taxpayers. Read More ›

California Consumer Group Seeks Enforcement Action Against Geico

by Staff, The Insurance Journal

“Our extensive analysis of Geico’s online rate quote system found that it is programmed to target unmarried low or moderate-income drivers for inflated rates,” Richard Holober, executive director of the group stated. “Targeted motorists either pay for excessive coverages they are falsely told are the lowest available, or Geico drives them away with these costly quotes. Either way, Geico is breaking California’s insurance regulations and civil rights law.” Read More ›

ConsumerWatch: Geico Accused Of Discriminatory Insurance Quotes

When was the last time your car insurance company asked about your job or if you had a college degree? On the Consumer Watch, Julie Watts says some are questioning the legality of Geico’s practices.

Geico Accused Of Discriminating Against ‘Working Class’ Customers

by Kathleen Pender, San Francisco Chronicle

Under Proposition 103, insurance companies must offer good drivers a policy with minimum coverages of $15,000 for a single injury, $30,000 for injury to more than one person in an accident, and $5,000 for property damage, called a “15/30/5 policy.” When a “working-class” person applies online, Geico’s website shows the lowest limits are $100,000 for a single injury, $300,000 for injury to more than one person and $50,000 for property damage, the [Consumer Federation of California] said. Read More ›

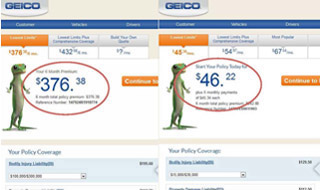

GEICO Discriminates Against Unmarried Low-Income Drivers, Consumer Federation Charges

[CFC press release:] GEICO Insurance Co. illegally deceives and discriminates against unmarried, lower or moderate-income motorists by quoting them much higher minimum automobile coverage levels than permitted under state law, the Consumer Federation of California (CFC) alleges in a petition filed today with the California Department of Insurance. Having uncovered this scheme, CFC is calling on the Department of Insurance to enforce state insurance and civil rights laws by ordering GEICO to halt these practices and impose penalties. The targets of GEICO’s deceptive rate quotes are good drivers who have all of these characteristics: are unmarried, not employed in a professional or executive occupation, have not completed college, and are not currently insured. Read More ›

GEICO Rips Off Single, Lower-Income Drivers, CFC Alleges

Read CFC’s enforcement complaint here. If you’re an unmarried, uninsured good driver and have anything less than a bachelor’s degree or a professional job, GEICO quotes you coverages it claims are its “Lowest Limits” that are in fact as much as 1000% more than the minimum it … Read More ›

Anthem Hack: Could The Insurer Have Prevented It?

by Matt O'Brien, San Jose Mercury News

[Critics] say encrypting personal data could have helped. “They claim it’s the expense. Really, there’s no excuse,” said Beth Givens, founder and director of San Diego-based Privacy Rights Clearinghouse. “They don’t want to take the time and effort to decode it.” … Anthem’s breach affected up to 80 million people, far more than the 37.5 million actually covered by the insurer as of December, according to the company’s most recent earnings report. Those hacked included not just Anthem employees but also many former Anthem subscribers, many of whom long ago dropped the insurer. Read More ›

State Fines Mercury Insurance $27.5 Million For Unapproved Fees

by Marc Lifsher, Los Angeles Times

State regulators have issued a record $27.5-million fine against Mercury Insurance Group for charging customers fees that had not been approved by the Department of Insurance. The order closes a long-running case that involved charges made in 180,000 automobile insurance transactions between 1999 and 2004. … “Mercury auto insurance consumers paid $27.5 million in unapproved fees,” said Commissioner Dave Jones. “While the $27.5 million fine against Mercury is significant, it is commensurate with the amount of money that was unlawfully collected from Mercury policyholders.” Read More ›

CFC Addresses Benefits and Risks of Driverless Cars

Noting that the technology could reduce accidents if it’s widely adopted, CFC Executive Director Richard Holober stressed the need to ensure that any savings get passed along to consumers under Proposition 103. He also cited concerns about who would have access to data from the vehicles, and of possible meddling by hackers. Read More ›

CFC: $148 Million In Insurance Savings For Ratepayers

Last year, CFC began intervening before the Department of Insurance in Prop 103 auto and homeowner insurance rate reviews. Our actuaries scrutinized data submitted by insurers, pointed out errors in calculations or loss projections, and persuaded regulators and insurers to cut their proposed rate increases. As a … Read More ›

Uber-rich transportation firms should be liable for death or injury

Update 8/27: The Consumer Federation of California (CFC) today removed its support for Assembly Bill 2293 (Bonilla) due to changes in the insurance coverage proposed for transportation network companies (TNCs). “An earlier version of AB 2293 which CFC supported mandated TNC coverage of one million dollars per [incident]. … Read More ›