Tag Archives: Medical Issues

California Insurance Commissioner Expresses Skepticism Over Anthem-Cigna Merger

by Ana B. Ibarra, KQED

“We are not aware of any peer-reviewed studies that have found that higher insurer market concentration has led to lower health insurance premiums,” [one expert] said. … Consumer advocates said the acquisition would make existing problems with health insurance worse. Anthem, they claimed, has already struggled with inaccuracies in provider directories, low quality ratings and poor management of grievances. Read More ›

Got A Health Care Grievance? There’s A Place To Complain

by Claudia Buck, Sacramento Bee

[MyPatientRights.org is] intended to provide an easy link to the state Department of Managed Health Care, which handles consumer complaints with the state’s 122 licensed health plans. … Last year, the help center received more than 102,000 requests for assistance. … Requests for help jumped by 60 percent compared with 2013, largely because of the implementation of the Affordable Care Act, according to the department. Read More ›

What’s Our Health Data Worth?

by Jerry Beilinson, Consumer Reports

Medical records shared among doctors and hospitals are covered by HIPAA, the medical privacy law, but data shared among app developers, financial firms, and others is unregulated. … Americans are worried about how health data of all kinds is shared, according to Consumer Reports’ research conducted in 2015. Nearly everyone surveyed – 91 percent – agreed that their consent should be required whenever health information is shared. And 45 percent … found it “creepy” when an ad targeting their medical conditions popped up in a web browser. Read More ›

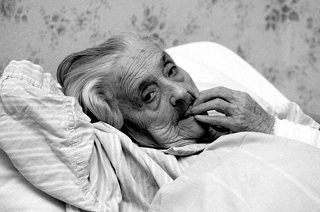

Abandoned Nursing Home Residents Live Months In Hospital, Waiting

by Anna Gorman, KQED

Nursing home residents are entitled to hearings under federal law to determine whether they should be readmitted after hospitalization. The state Department of Health Care Services holds the administrative hearings, but has said it is not responsible for enforcing the rulings. But the state Department of Public Health, which oversees nursing homes, neglects to enforce the rulings and sometimes disagrees with them, according to advocates and court documents. … And since many nursing home residents have publicly-funded insurance, it means taxpayers are on the hook for hospital stays long after the patients are ready for discharge. Read More ›

Taming Drug Prices By Pulling Back The Curtain Online

by Katie Thomas, New York Times

A few entrepreneurs say they are aiming to fundamentally change the way people buy drugs, bringing the industry into the digital age by disclosing the lowest prices for generic prescriptions to allow comparison-shopping. … Nearly 90 percent of the prescriptions dispensed in the United States are for generic drugs, according to IMS Health, a consulting firm. … The listed price for a 30-day supply of the generic version of Lipitor, for example, is $196 at Kmart, according to GoodRx, and $61 at Kroger. With a coupon obtained through GoodRx, the drug is about $12. Blink Health is offering Lipitor for $9.94. Read More ›

Hard Drives Holding Health Data Missing At Medical Insurer

by Chris Rauber, San Francisco Business Times

The latest in a series of huge data losses in the health care realm — health insurer Centene’s loss of six hard drives containing personal information on 950,000 enrollees — raises more questions about the security of health data that consumers entrust to insurance companies, hospital systems, Medicare, Medicaid and other big players. … Confidential health care data can sell in murky portions of the Internet for $10 to $50 per record — far more than the roughly $1 a simple credit-card number is worth. Medicare records are even more valuable, … and can sell for as much as $470 per record. Read More ›

California’s Four Largest Health Plans Could Owe State $10 Billion In Back Taxes

by Tracy Seipel, San Jose Mercury News

Blue Shield and Blue Cross already lost a key round in a state appellate court. The case against Kaiser and Health Net heads to a Los Angeles court Friday. At the heart of the debate is a century-old section in the state constitution that requires almost all insurers to pay a 2.35 percent tax on the premiums they collect each year. The tax is paid in lieu of almost all other state taxes. Yet for decades, industry critics say, Kaiser, Blue Cross, Blue Shield and Health Net have managed to avoid paying the premium tax on the majority of their business. Read More ›

California Regulators Are Urged To Scrutinize Health Insurance Mega-Mergers

by Chad Terhune, Los Angeles Times

There’s a lot at stake for families and employers if the deals go through and leave three health insurers in control of nearly half of the U.S. commercial insurance market. … Much of the debate centers on whether insurers should be required to limit rate increases for a time, expand their provider networks and make other pledges to improve patient care in order to win regulatory approval at the state level. … Consumer advocates say they fear that existing problems over affordability and access to care will get worse as insurers consolidate market power. Read More ›

Supreme Court Rejects Class-Action Suit Against DirecTV

by Robert Barnes, Washington Post

“These decisions have predictably resulted in the deprivation of consumers’ rights to seek redress for losses, and turning the coin, they have insulated powerful economic interests from liability for violations of consumer protection laws,” wrote [dissenting Justice Ruth Bader] Ginsburg. … “It has become routine, in a large part due to this court’s decisions, for powerful economic enterprises to write into their form contracts with consumers and employees no class-action arbitration clauses … further degrading the rights of consumers and further insulating already powerful economic entities.” Read More ›

Nonprofit Blue Shield Accused Of Backing Out Of $140-Million Charity Pledge

by Chad Terhune, Los Angeles Times

Blue Shield’s corporate conduct has come under intense scrutiny for the past year after officials revoked its longtime state tax exemption. Auditors at the California Franchise Tax Board criticized the insurer for stockpiling “extraordinarily high surpluses” of $4 billion and for failing to offer more affordable coverage as a nonprofit. California Insurance Commissioner Dave Jones is also investigating Blue Shield’s disclosures on executive compensation. Read More ›

Beware The Fine Print: Arbitration Everywhere, Stacking The Deck Of Justice

by Jessica Silver-Greenberg and Robert Gebeloff, The New York Times

The move to block class actions was engineered by a Wall Street-led coalition of credit card companies and retailers, according to interviews with coalition members and court records. Strategizing from law offices on Park Avenue and in Washington, members of the group came up with a plan to insulate themselves from the costly lawsuits. Their work culminated in two Supreme Court rulings, in 2011 and 2013, that enshrined the use of class-action bans in contracts. The decisions … upended decades of jurisprudence. Read More ›

Utilities Spend Lots Of Public’s Money To Influence State Politics

by Teri Sforza, The Orange County Register

“Your No. 1 example, PG&E, is textbook!” [said Chapman University political science professor Mark Chapin Johnson.] “They answer to the state through the PUC, not their shareholders. … Whenever PG&E wishes to contribute vast sums of ratepayers’ monthly payments to the political process, all PG&E needs do is gain permission to raise rates with the PUC to cover such contributions. Public shareholders or ratepayers have no say in the process. Is this a great system or what? Talk about incestuous!” Read More ›

Consumers Can Check Medical Prices, Quality Scores On New State Website

by Chad Terhune, Los Angeles Times

California and 44 other states received a failing grade in an annual report card that measures how much access patients have to actual prices for medical care. The new online tool seeks to remedy that. … Consumers could use the website to check whether the price they were quoted for a routine lab test or procedure is out of line with the average cost in their community. Armed with that information, a patient could shop around or negotiate for a lower fee. … Researchers said the data also show a wide variation on the quality of care that patients receive from different providers.

Read More ›