Tag Archives: Scams

Fake celebrity skin care ads dupe consumers with ‘Free Trial’ offers

by David Emory, Snopes

The perpetrators use networks of bogus web sites, social media, and e-commerce technology to trick users into ordering “free trials” of supposedly celebrity-endorsed products, only to find they’ve unknowingly signed up to receive regular shipments for which they’re automatically charged on a monthly basis. Read More ›

Save Social Security! Group Accused of Scams Targets N.J. Seniors

by Karin Price Mueller, NJ.com

A complaint-laden organization that solicits donations nationwide is making a play in New Jersey. The letter had many warning signs of a scam: telling the recipient to “rush,” saying the recipient had been “specially selected” and saying the mailing was “exclusive.” Read More ›

Why A Staggering Number Of Americans Have Stopped Using The Internet The Way They Used To

by Andrea Peterson, Washington Post

Nearly one in two Internet users say privacy and security concerns have now stopped them from doing basic things online — such as posting to social networks, expressing opinions in forums or even buying things from websites, according to a new government survey released Friday. … When asked to list their biggest concerns, nearly two out of three respondents cited identity theft, while nearly half brought up credit card or banking fraud. About one in five listed data collection by the government. Read More ›

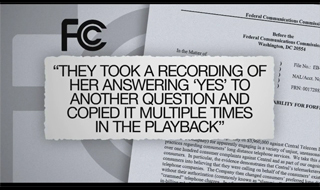

Call Kurtis: Why You May Not Want To Say A Word During An Unexpected Call

In 2014 the Federal Communications Commission fined Central Telecom Long Distance $3.9 million, “For unjust, unreasonable and deceptive practices.” In one woman’s FCC complaint, she says the company took a recording of her answering “yes” to another question and copied it multiple times on the playback, which ultimately changed her preferred long distance telephone carrier without her authorization. “It’s definitely not honest, and a little shady, absolutely,” said Danielle Spang with the BBB. Read More ›

Gender-Based Price Differences Could Be Banned

by Allen Young, Sacramento Business Journal

Senate Bill 899 passed the Senate Judiciary Committee along party lines this week and now heads to the Senate floor. … Female consumers pay 7 percent more on average for products that are essentially the same as the male version, according to a study released in December by a public consumer watchdog agency in New York City. The study looked at 800 consumer products with “clear male and female versions” and found that products targeted toward girls and women were more expensive 42 percent of the time. Read More ›

These Are U.S. Consumers’ Top 5 Complaints

by Krystal Steinmetz, Money Talks News

Debt collection gripes made up 29 percent of the complaint calls to the FTC last year, while 16 percent of the complaints were related to identity theft. … “We recognize that identity theft and unlawful debt collection practices continue to cause significant harm to many consumers,” Jessica Rich, director of the FTC’s Bureau of Consumer Protection, said in a statement. “Steps like the recent upgrade to IdentityTheft.gov and our leadership of a nationwide initiative to combat unlawful debt collection practices are critical to our ongoing work to protect consumers from these harms.” Read More ›

Nonprofit Blue Shield Accused Of Backing Out Of $140-Million Charity Pledge

by Chad Terhune, Los Angeles Times

Blue Shield’s corporate conduct has come under intense scrutiny for the past year after officials revoked its longtime state tax exemption. Auditors at the California Franchise Tax Board criticized the insurer for stockpiling “extraordinarily high surpluses” of $4 billion and for failing to offer more affordable coverage as a nonprofit. California Insurance Commissioner Dave Jones is also investigating Blue Shield’s disclosures on executive compensation. Read More ›

Beware The Fine Print: Arbitration Everywhere, Stacking The Deck Of Justice

by Jessica Silver-Greenberg and Robert Gebeloff, The New York Times

The move to block class actions was engineered by a Wall Street-led coalition of credit card companies and retailers, according to interviews with coalition members and court records. Strategizing from law offices on Park Avenue and in Washington, members of the group came up with a plan to insulate themselves from the costly lawsuits. Their work culminated in two Supreme Court rulings, in 2011 and 2013, that enshrined the use of class-action bans in contracts. The decisions … upended decades of jurisprudence. Read More ›

A Fiat Chrysler Discount Will Cost You Your Right To Sue

by David Lazarus, Los Angeles Times

Until now, experts say, no major car manufacturer has sought to encourage customers to forgo their right to sue. … Many large businesses prefer arbitration because settlements are limited and because professional arbitrators often favor the corporate side. Arbitrators’ fees are typically paid by the company in a dispute. A 2007 report by Public Citizen found that over a four-year period, arbitrators ruled in favor of banks and credit card companies 94 percent of the time in disputes with California consumers. Read More ›

More Trouble For ITT Education Services: Agency Restricts For-Profit’s Use Of Federal Student Aid

by Ashlee Kieler, Consumerist

The new restrictions from the Dept. of Education are just the latest regulatory and legal issue for ITT Educational Services. Last month, the company revealed that the Department of Justice was looking into whether the company defrauded the federal government. … Back in May, the SEC filed fraud charges against current and former executives with the company for their part in concealing problems with company-run student loan programs. … The company has faced actions from several states, including the suspension of GI Bill Eligibility in the state of California in May of this year. Read More ›

For-Profit Colleges Accused Of Fraud Still Receive U.S. Funds

by Patricia Cohen, The New York Times

For-profit schools enroll about 12 percent of the nation’s college students, yet they account for nearly half of student loan defaults. … Kaplan [Career Institute’s] schools, including its online California law school, where only one in five students graduates, received $776.3 million worth of federal student loans and grants last year. Because it lacks bar association accreditation, most graduates outside California are not allowed to take a bar exam. Read More ›

Uber Sued Over Alleged Rapes By Drivers

by Marisa Kendall, The Recorder, San Francisco

“Unfortunately, despite its self-proclaimed ‘commitment to safety,’ opening the Uber app and setting the pick-up location has proven to be the modern day equivalent of electronic hitchhiking,” the lawyers wrote. “Buyer beware—we all know how those horror movies end.” … The two assaults are part of a pattern of “similarly heinous, but avoidable attacks,” the Jane Does’ lawyers wrote. They claim more than 30 sexual assaults by Uber drivers against passengers have been reported in the media over the past two years.

Read More ›

Auto Insurance Company GEICO Pays Out Multi-Million Dollar Settlement

by Tom Vacar, Fox 2 (KTVU Oakland)

The Consumer Federation of California charges that GEICO tried to discourage less preferable customers. Those include those not college-educated, not professional, not executive, a woman, an unmarried person, or those not currently insured. They would not be offered those lowest legal minimum [rates]. Read More ›