Tag Archives: Class Action

Uber Drivers Get Big Boost In Lawsuit Against Company

by Carolyn Said, San Francisco Chronicle

U.S. District Judge Edward Chen ruled that even drivers who accepted mandatory arbitration in their Uber contract should be included in the [class-action suit], saying that clause was unenforceable. That means the majority of the 160,000 people who have ever driven for Uber in California are now part of the class. … If the drivers win, [their lawyer] has said she’ll next seek a nationwide class-action. … The Uber class-action is the furthest along of a bevy of lawsuits against companies such as Lyft, Postmates, Instacart, Caviar and Handy in which gig workers are seeking the protections and rights of employees. Read More ›

Beware The Fine Print: Arbitration Everywhere, Stacking The Deck Of Justice

by Jessica Silver-Greenberg and Robert Gebeloff, The New York Times

The move to block class actions was engineered by a Wall Street-led coalition of credit card companies and retailers, according to interviews with coalition members and court records. Strategizing from law offices on Park Avenue and in Washington, members of the group came up with a plan to insulate themselves from the costly lawsuits. Their work culminated in two Supreme Court rulings, in 2011 and 2013, that enshrined the use of class-action bans in contracts. The decisions … upended decades of jurisprudence. Read More ›

CFPB May Let You Sue Your Bank Instead Of Going To Arbitration

“Consumers should not be asked to sign away their legal rights when they open a bank account or credit card,” CFPB Director Richard Cordray said. “Companies are using the arbitration clause as a free pass to sidestep the courts … ” In a first step toward potential new rules, the CFPB is publishing an outline of proposals under consideration in preparation for forming a small business review panel to gather feedback from industry stakeholders. … [New rules would apply to] credit cards, checking and deposit accounts, prepaid cards, money transfer services and several types of loans. Read More ›

CFPB To Consider Rules That Would Revoke Banks’ “License To Steal”

by Chris Morran, Consumerist

Earlier this year, the Bureau released its first report on arbitration in the financial products sector. It found that while the clauses are incredibly prevalent — 92% of prepaid debit cards and 88% of cellphone contracts use them — most consumers are completely unaware if they are affected. According to the CFPB, of those Americans constrained by arbitration agreements, fewer than 7% understood that this meant they had given up their right to file a lawsuit. “Consumers should not be asked to sign away their legal rights when they open a bank account or credit card,” said CFPB Director Richard Cordray in statement. Read More ›

Uber Drivers Granted Class-Action Status In Legal Battle

by Tracey Lien, Los Angeles Times

Uber now stands to lose far more than if the case had proceeded as a suit involving only three plaintiffs. In addition to potentially being on the hook for back wages, sick leave, expenses and benefits, the company could be ordered to pay gratuities owed to thousands of former drivers. “We’re talking about millions of dollars,” said Lonnie Giamela of labor and employment firm Fisher & Phillips. And that doesn’t even touch on what a loss would mean for Uber’s independent contractor-reliant business model, which has earned the company a $50-billion valuation. Read More ›

Will Uber Drivers Get Class-Action Status For Employment Case?

by Carolyn Said, San Francisco Chronicle

The case’s outcome also looms over other on-demand companies because workers deemed employees have mandates on wages and benefits that contractors do not. If the drivers win class-action status and ultimately prevail, Uber would be faced with a sweeping overhaul of its relationship with drivers that would “radically change” the app and challenge Uber’s business model. Read More ›

Uber: Disability Laws Don’t Apply To Us

by Nina Strochlic, The Daily Beast

In three ADA-related cases over the past eight months, in California, Texas, and Arizona, Uber has been slammed with lawsuits that allege the company discriminates against blind and wheelchair-using passengers. The suits demand Uber abide by the ADA, but Uber claims that because it’s a technology company, not a transportation service, it doesn’t fall under the ADA’s jurisdiction. … The disability-rights movement is urging the courts and lawmakers to end the impunity. Read More ›

Lumber Liquidators Sued Over Formaldehyde Allegations

by Chris Morran, Consumerist

The suit alleges … the company “breached their warranties by manufacturing, selling and/or distributing flooring products with levels of formaldehyde that exceed the CARB standards, or by making affirmative representations regarding CARB compliance without knowledge of its truth.” Lumber Liquidators is also accused of the California Business and Professions Code’s prohibitions against “unlawful, unfair, or fraudulent business act or practice,” false advertising. Additionally, the plaintiffs allege that misrepresenting the [California Air Resources Board] certification of the wood violates the California Consumer Legal Remedies Act. Read More ›

iPhone Users Sue Claiming False Advertising, Cloud Storage Hawking

by Laura Northrup, Consumerist

The iPhone users’ attorneys claim that users aren’t told how much of their already meager storage capacity they will lose when upgrading their phone’s operating system. “Apple fails to disclose that upgrading from iOS 7 to iOS 8 will cost a Device user between 600 MB and 1.3 GB of storage space – a result that no consumer could reasonably anticipate,” they point out. … Once space runs out, the iDevice asks the user whether they’d like to rent some additional iCloud space. “For this service, Apple charges prices ranging from $0.99 to $29.99 per month,” the complaint notes. Read More ›

Jury Sides With Apple In iPod Antitrust Case

by Julia Love, San Jose Mercury News

Plaintiffs’ lawyer Patrick Coughlin said his team wanted jurors to evaluate only the new security codes that limited downloads to the iTunes store, effectively blocking competing programs like RealNetworks’ Harmony. But instead, jurors considered whether those features, taken together with other new offerings in iTunes 7.0 such as games and movies, improved the user experience, making the plaintiffs’ case a tougher sell, Coughlin said. He vowed to appeal the case. Read More ›

Comcast Sued For Turning Home Wi-Fi Routers Into Public Hotspots

by Benny Evangelista, San Francisco Chronicle

The suit claims the company turns the service on without permission and places “the costs of its national Wi-Fi network onto its customers.” … Tests showed that under heavy use, the secondary channel adds 30 to 40 percent more costs to a customer’s electricity bill than the modem itself, the suit said. The suit also said “the data and information on a Comcast customer’s network is at greater risk” because the hotspot network “allows strangers to connect to the Internet through the same wireless router used by Comcast customers.” Read More ›

Google Sued Over Kids’ In-App Currency Purchases

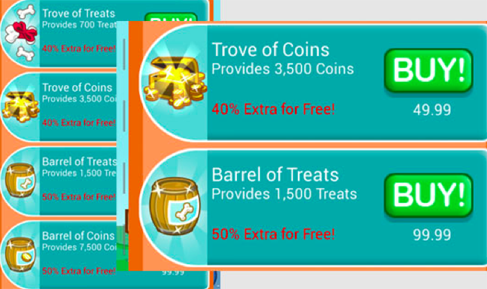

by Chris Morran, Consumerist

Because Google makes it so easy for users to make these in-game purchases, the plaintiff argues that games and apps are being created primarily for the purpose of enticing consumers to spend money on things like in-game currency. “Such games, by design, are highly addictive,” reads the complaint. Read More ›